[Windows Forms - C# version] NetWinCharts\CSharpWinCharts\finance.cs

using System;

using ChartDirector;

namespace CSharpChartExplorer

{

public class finance : DemoModule

{

//Name of demo module

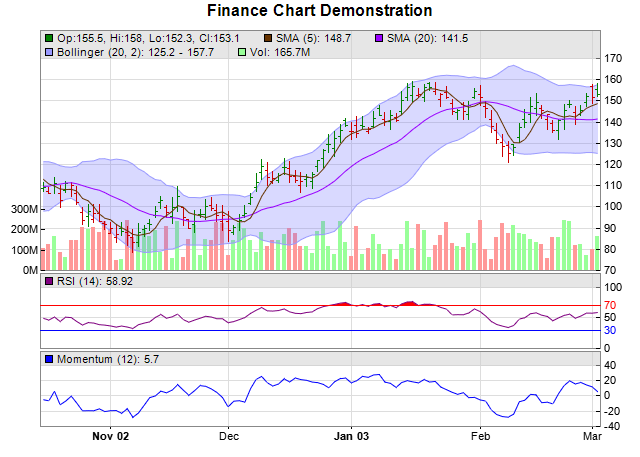

public string getName() { return "Finance Chart (1)"; }

//Number of charts produced in this demo module

public int getNoOfCharts() { return 1; }

//Main code for creating chart.

//Note: the argument chartIndex is unused because this demo only has 1 chart.

public void createChart(WinChartViewer viewer, int chartIndex)

{

// Create a finance chart demo containing 100 days of data

int noOfDays = 100;

// To compute moving averages starting from the first day, we need to get extra data

// points before the first day

int extraDays = 30;

// In this exammple, we use a random number generator utility to simulate the data. We

// set up the random table to create 6 cols x (noOfDays + extraDays) rows, using 9 as

// the seed.

RanTable rantable = new RanTable(9, 6, noOfDays + extraDays);

// Set the 1st col to be the timeStamp, starting from Sep 4, 2002, with each row

// representing one day, and counting week days only (jump over Sat and Sun)

rantable.setDateCol(0, new DateTime(2002, 9, 4), 86400, true);

// Set the 2nd, 3rd, 4th and 5th columns to be high, low, open and close data. The open

// value starts from 100, and the daily change is random from -5 to 5.

rantable.setHLOCCols(1, 100, -5, 5);

// Set the 6th column as the vol data from 5 to 25 million

rantable.setCol(5, 50000000, 250000000);

// Now we read the data from the table into arrays

double[] timeStamps = rantable.getCol(0);

double[] highData = rantable.getCol(1);

double[] lowData = rantable.getCol(2);

double[] openData = rantable.getCol(3);

double[] closeData = rantable.getCol(4);

double[] volData = rantable.getCol(5);

// Create a FinanceChart object of width 640 pixels

FinanceChart c = new FinanceChart(640);

// Add a title to the chart

c.addTitle("Finance Chart Demonstration");

// Set the data into the finance chart object

c.setData(timeStamps, highData, lowData, openData, closeData, volData, extraDays);

// Add the main chart with 240 pixels in height

c.addMainChart(240);

// Add a 5 period simple moving average to the main chart, using brown color

c.addSimpleMovingAvg(5, 0x663300);

// Add a 20 period simple moving average to the main chart, using purple color

c.addSimpleMovingAvg(20, 0x9900ff);

// Add HLOC symbols to the main chart, using green/red for up/down days

c.addHLOC(0x008000, 0xcc0000);

// Add 20 days bollinger band to the main chart, using light blue (9999ff) as the border

// and semi-transparent blue (c06666ff) as the fill color

c.addBollingerBand(20, 2, 0x9999ff, unchecked((int)0xc06666ff));

// Add a 75 pixels volume bars sub-chart to the bottom of the main chart, using

// green/red/grey for up/down/flat days

c.addVolBars(75, 0x99ff99, 0xff9999, 0x808080);

// Append a 14-days RSI indicator chart (75 pixels high) after the main chart. The main

// RSI line is purple (800080). Set threshold region to +/- 20 (that is, RSI = 50 +/-

// 25). The upper/lower threshold regions will be filled with red (ff0000)/blue

// (0000ff).

c.addRSI(75, 14, 0x800080, 20, 0xff0000, 0x0000ff);

// Append a 12-days momentum indicator chart (75 pixels high) using blue (0000ff) color.

c.addMomentum(75, 12, 0x0000ff);

// Output the chart

viewer.Chart = c;

}

}

}

[Windows Forms - VB Version] NetWinCharts\VBNetWinCharts\finance.vb

Imports System

Imports Microsoft.VisualBasic

Imports ChartDirector

Public Class finance

Implements DemoModule

'Name of demo module

Public Function getName() As String Implements DemoModule.getName

Return "Finance Chart (1)"

End Function

'Number of charts produced in this demo module

Public Function getNoOfCharts() As Integer Implements DemoModule.getNoOfCharts

Return 1

End Function

'Main code for creating chart.

'Note: the argument chartIndex is unused because this demo only has 1 chart.

Public Sub createChart(viewer As WinChartViewer, chartIndex As Integer) _

Implements DemoModule.createChart

' Create a finance chart demo containing 100 days of data

Dim noOfDays As Integer = 100

' To compute moving averages starting from the first day, we need to get extra data points

' before the first day

Dim extraDays As Integer = 30

' In this exammple, we use a random number generator utility to simulate the data. We set up

' the random table to create 6 cols x (noOfDays + extraDays) rows, using 9 as the seed.

Dim rantable As RanTable = New RanTable(9, 6, noOfDays + extraDays)

' Set the 1st col to be the timeStamp, starting from Sep 4, 2002, with each row representing

' one day, and counting week days only (jump over Sat and Sun)

rantable.setDateCol(0, DateSerial(2002, 9, 4), 86400, True)

' Set the 2nd, 3rd, 4th and 5th columns to be high, low, open and close data. The open value

' starts from 100, and the daily change is random from -5 to 5.

rantable.setHLOCCols(1, 100, -5, 5)

' Set the 6th column as the vol data from 5 to 25 million

rantable.setCol(5, 50000000, 250000000)

' Now we read the data from the table into arrays

Dim timeStamps() As Double = rantable.getCol(0)

Dim highData() As Double = rantable.getCol(1)

Dim lowData() As Double = rantable.getCol(2)

Dim openData() As Double = rantable.getCol(3)

Dim closeData() As Double = rantable.getCol(4)

Dim volData() As Double = rantable.getCol(5)

' Create a FinanceChart object of width 640 pixels

Dim c As FinanceChart = New FinanceChart(640)

' Add a title to the chart

c.addTitle("Finance Chart Demonstration")

' Set the data into the finance chart object

c.setData(timeStamps, highData, lowData, openData, closeData, volData, extraDays)

' Add the main chart with 240 pixels in height

c.addMainChart(240)

' Add a 5 period simple moving average to the main chart, using brown color

c.addSimpleMovingAvg(5, &H663300)

' Add a 20 period simple moving average to the main chart, using purple color

c.addSimpleMovingAvg(20, &H9900ff)

' Add HLOC symbols to the main chart, using green/red for up/down days

c.addHLOC(&H008000, &Hcc0000)

' Add 20 days bollinger band to the main chart, using light blue (9999ff) as the border and

' semi-transparent blue (c06666ff) as the fill color

c.addBollingerBand(20, 2, &H9999ff, &Hc06666ff)

' Add a 75 pixels volume bars sub-chart to the bottom of the main chart, using

' green/red/grey for up/down/flat days

c.addVolBars(75, &H99ff99, &Hff9999, &H808080)

' Append a 14-days RSI indicator chart (75 pixels high) after the main chart. The main RSI

' line is purple (800080). Set threshold region to +/- 20 (that is, RSI = 50 +/- 25). The

' upper/lower threshold regions will be filled with red (ff0000)/blue (0000ff).

c.addRSI(75, 14, &H800080, 20, &Hff0000, &H0000ff)

' Append a 12-days momentum indicator chart (75 pixels high) using blue (0000ff) color.

c.addMomentum(75, 12, &H0000ff)

' Output the chart

viewer.Chart = c

End Sub

End Class

[WPF - C#] NetWPFCharts\CSharpWPFCharts\finance.cs

using System;

using ChartDirector;

namespace CSharpWPFCharts

{

public class finance : DemoModule

{

//Name of demo module

public string getName() { return "Finance Chart (1)"; }

//Number of charts produced in this demo module

public int getNoOfCharts() { return 1; }

//Main code for creating chart.

//Note: the argument chartIndex is unused because this demo only has 1 chart.

public void createChart(WPFChartViewer viewer, int chartIndex)

{

// Create a finance chart demo containing 100 days of data

int noOfDays = 100;

// To compute moving averages starting from the first day, we need to get extra data

// points before the first day

int extraDays = 30;

// In this exammple, we use a random number generator utility to simulate the data. We

// set up the random table to create 6 cols x (noOfDays + extraDays) rows, using 9 as

// the seed.

RanTable rantable = new RanTable(9, 6, noOfDays + extraDays);

// Set the 1st col to be the timeStamp, starting from Sep 4, 2002, with each row

// representing one day, and counting week days only (jump over Sat and Sun)

rantable.setDateCol(0, new DateTime(2002, 9, 4), 86400, true);

// Set the 2nd, 3rd, 4th and 5th columns to be high, low, open and close data. The open

// value starts from 100, and the daily change is random from -5 to 5.

rantable.setHLOCCols(1, 100, -5, 5);

// Set the 6th column as the vol data from 5 to 25 million

rantable.setCol(5, 50000000, 250000000);

// Now we read the data from the table into arrays

double[] timeStamps = rantable.getCol(0);

double[] highData = rantable.getCol(1);

double[] lowData = rantable.getCol(2);

double[] openData = rantable.getCol(3);

double[] closeData = rantable.getCol(4);

double[] volData = rantable.getCol(5);

// Create a FinanceChart object of width 640 pixels

FinanceChart c = new FinanceChart(640);

// Add a title to the chart

c.addTitle("Finance Chart Demonstration");

// Set the data into the finance chart object

c.setData(timeStamps, highData, lowData, openData, closeData, volData, extraDays);

// Add the main chart with 240 pixels in height

c.addMainChart(240);

// Add a 5 period simple moving average to the main chart, using brown color

c.addSimpleMovingAvg(5, 0x663300);

// Add a 20 period simple moving average to the main chart, using purple color

c.addSimpleMovingAvg(20, 0x9900ff);

// Add HLOC symbols to the main chart, using green/red for up/down days

c.addHLOC(0x008000, 0xcc0000);

// Add 20 days bollinger band to the main chart, using light blue (9999ff) as the border

// and semi-transparent blue (c06666ff) as the fill color

c.addBollingerBand(20, 2, 0x9999ff, unchecked((int)0xc06666ff));

// Add a 75 pixels volume bars sub-chart to the bottom of the main chart, using

// green/red/grey for up/down/flat days

c.addVolBars(75, 0x99ff99, 0xff9999, 0x808080);

// Append a 14-days RSI indicator chart (75 pixels high) after the main chart. The main

// RSI line is purple (800080). Set threshold region to +/- 20 (that is, RSI = 50 +/-

// 25). The upper/lower threshold regions will be filled with red (ff0000)/blue

// (0000ff).

c.addRSI(75, 14, 0x800080, 20, 0xff0000, 0x0000ff);

// Append a 12-days momentum indicator chart (75 pixels high) using blue (0000ff) color.

c.addMomentum(75, 12, 0x0000ff);

// Output the chart

viewer.Chart = c;

}

}

}

[ASP.NET Web Forms - C# version] NetWebCharts\CSharpASP\finance.aspx

(Click here on how to convert this code to code-behind style.)<%@ Page Language="C#" Debug="true" %>

<%@ Import Namespace="ChartDirector" %>

<%@ Register TagPrefix="chart" Namespace="ChartDirector" Assembly="netchartdir" %>

<!DOCTYPE html>

<script runat="server">

//

// Page Load event handler

//

protected void Page_Load(object sender, EventArgs e)

{

// Create a finance chart demo containing 100 days of data

int noOfDays = 100;

// To compute moving averages starting from the first day, we need to get extra data points

// before the first day

int extraDays = 30;

// In this exammple, we use a random number generator utility to simulate the data. We set up

// the random table to create 6 cols x (noOfDays + extraDays) rows, using 9 as the seed.

RanTable rantable = new RanTable(9, 6, noOfDays + extraDays);

// Set the 1st col to be the timeStamp, starting from Sep 4, 2002, with each row representing

// one day, and counting week days only (jump over Sat and Sun)

rantable.setDateCol(0, new DateTime(2002, 9, 4), 86400, true);

// Set the 2nd, 3rd, 4th and 5th columns to be high, low, open and close data. The open value

// starts from 100, and the daily change is random from -5 to 5.

rantable.setHLOCCols(1, 100, -5, 5);

// Set the 6th column as the vol data from 5 to 25 million

rantable.setCol(5, 50000000, 250000000);

// Now we read the data from the table into arrays

double[] timeStamps = rantable.getCol(0);

double[] highData = rantable.getCol(1);

double[] lowData = rantable.getCol(2);

double[] openData = rantable.getCol(3);

double[] closeData = rantable.getCol(4);

double[] volData = rantable.getCol(5);

// Create a FinanceChart object of width 640 pixels

FinanceChart c = new FinanceChart(640);

// Add a title to the chart

c.addTitle("Finance Chart Demonstration");

// Set the data into the finance chart object

c.setData(timeStamps, highData, lowData, openData, closeData, volData, extraDays);

// Add the main chart with 240 pixels in height

c.addMainChart(240);

// Add a 5 period simple moving average to the main chart, using brown color

c.addSimpleMovingAvg(5, 0x663300);

// Add a 20 period simple moving average to the main chart, using purple color

c.addSimpleMovingAvg(20, 0x9900ff);

// Add HLOC symbols to the main chart, using green/red for up/down days

c.addHLOC(0x008000, 0xcc0000);

// Add 20 days bollinger band to the main chart, using light blue (9999ff) as the border and

// semi-transparent blue (c06666ff) as the fill color

c.addBollingerBand(20, 2, 0x9999ff, unchecked((int)0xc06666ff));

// Add a 75 pixels volume bars sub-chart to the bottom of the main chart, using green/red/grey

// for up/down/flat days

c.addVolBars(75, 0x99ff99, 0xff9999, 0x808080);

// Append a 14-days RSI indicator chart (75 pixels high) after the main chart. The main RSI line

// is purple (800080). Set threshold region to +/- 20 (that is, RSI = 50 +/- 25). The

// upper/lower threshold regions will be filled with red (ff0000)/blue (0000ff).

c.addRSI(75, 14, 0x800080, 20, 0xff0000, 0x0000ff);

// Append a 12-days momentum indicator chart (75 pixels high) using blue (0000ff) color.

c.addMomentum(75, 12, 0x0000ff);

// Output the chart

WebChartViewer1.Image = c.makeWebImage(Chart.SVG);

}

</script>

<html>

<head>

<script type="text/javascript" src="cdjcv.js"></script>

</head>

<body>

<chart:WebChartViewer id="WebChartViewer1" runat="server" />

</body>

</html>

[ASP.NET Web Forms - VB Version] NetWebCharts\VBNetASP\finance.aspx

(Click here on how to convert this code to code-behind style.)<%@ Page Language="VB" Debug="true" %>

<%@ Import Namespace="ChartDirector" %>

<%@ Register TagPrefix="chart" Namespace="ChartDirector" Assembly="netchartdir" %>

<!DOCTYPE html>

<script runat="server">

'

' Page Load event handler

'

Protected Sub Page_Load(ByVal sender As System.Object, ByVal e As System.EventArgs)

' Create a finance chart demo containing 100 days of data

Dim noOfDays As Integer = 100

' To compute moving averages starting from the first day, we need to get extra data points

' before the first day

Dim extraDays As Integer = 30

' In this exammple, we use a random number generator utility to simulate the data. We set up the

' random table to create 6 cols x (noOfDays + extraDays) rows, using 9 as the seed.

Dim rantable As RanTable = New RanTable(9, 6, noOfDays + extraDays)

' Set the 1st col to be the timeStamp, starting from Sep 4, 2002, with each row representing one

' day, and counting week days only (jump over Sat and Sun)

rantable.setDateCol(0, DateSerial(2002, 9, 4), 86400, True)

' Set the 2nd, 3rd, 4th and 5th columns to be high, low, open and close data. The open value

' starts from 100, and the daily change is random from -5 to 5.

rantable.setHLOCCols(1, 100, -5, 5)

' Set the 6th column as the vol data from 5 to 25 million

rantable.setCol(5, 50000000, 250000000)

' Now we read the data from the table into arrays

Dim timeStamps() As Double = rantable.getCol(0)

Dim highData() As Double = rantable.getCol(1)

Dim lowData() As Double = rantable.getCol(2)

Dim openData() As Double = rantable.getCol(3)

Dim closeData() As Double = rantable.getCol(4)

Dim volData() As Double = rantable.getCol(5)

' Create a FinanceChart object of width 640 pixels

Dim c As FinanceChart = New FinanceChart(640)

' Add a title to the chart

c.addTitle("Finance Chart Demonstration")

' Set the data into the finance chart object

c.setData(timeStamps, highData, lowData, openData, closeData, volData, extraDays)

' Add the main chart with 240 pixels in height

c.addMainChart(240)

' Add a 5 period simple moving average to the main chart, using brown color

c.addSimpleMovingAvg(5, &H663300)

' Add a 20 period simple moving average to the main chart, using purple color

c.addSimpleMovingAvg(20, &H9900ff)

' Add HLOC symbols to the main chart, using green/red for up/down days

c.addHLOC(&H008000, &Hcc0000)

' Add 20 days bollinger band to the main chart, using light blue (9999ff) as the border and

' semi-transparent blue (c06666ff) as the fill color

c.addBollingerBand(20, 2, &H9999ff, &Hc06666ff)

' Add a 75 pixels volume bars sub-chart to the bottom of the main chart, using green/red/grey

' for up/down/flat days

c.addVolBars(75, &H99ff99, &Hff9999, &H808080)

' Append a 14-days RSI indicator chart (75 pixels high) after the main chart. The main RSI line

' is purple (800080). Set threshold region to +/- 20 (that is, RSI = 50 +/- 25). The upper/lower

' threshold regions will be filled with red (ff0000)/blue (0000ff).

c.addRSI(75, 14, &H800080, 20, &Hff0000, &H0000ff)

' Append a 12-days momentum indicator chart (75 pixels high) using blue (0000ff) color.

c.addMomentum(75, 12, &H0000ff)

' Output the chart

WebChartViewer1.Image = c.makeWebImage(Chart.SVG)

End Sub

</script>

<html>

<head>

<script type="text/javascript" src="cdjcv.js"></script>

</head>

<body>

<chart:WebChartViewer id="WebChartViewer1" runat="server" />

</body>

</html>

[ASP.NET MVC - Controller] NetMvcCharts\Controllers\FinanceController.cs

using System;

using System.Web.Mvc;

using ChartDirector;

namespace NetMvcCharts.Controllers

{

public class FinanceController : Controller

{

//

// Default Action

//

public ActionResult Index()

{

ViewBag.Title = "Finance Chart (1)";

createChart(ViewBag.Viewer = new RazorChartViewer(HttpContext, "chart1"));

return View("~/Views/Shared/ChartView.cshtml");

}

//

// Create chart

//

private void createChart(RazorChartViewer viewer)

{

// Create a finance chart demo containing 100 days of data

int noOfDays = 100;

// To compute moving averages starting from the first day, we need to get extra data points

// before the first day

int extraDays = 30;

// In this exammple, we use a random number generator utility to simulate the data. We set up

// the random table to create 6 cols x (noOfDays + extraDays) rows, using 9 as the seed.

RanTable rantable = new RanTable(9, 6, noOfDays + extraDays);

// Set the 1st col to be the timeStamp, starting from Sep 4, 2002, with each row representing

// one day, and counting week days only (jump over Sat and Sun)

rantable.setDateCol(0, new DateTime(2002, 9, 4), 86400, true);

// Set the 2nd, 3rd, 4th and 5th columns to be high, low, open and close data. The open value

// starts from 100, and the daily change is random from -5 to 5.

rantable.setHLOCCols(1, 100, -5, 5);

// Set the 6th column as the vol data from 5 to 25 million

rantable.setCol(5, 50000000, 250000000);

// Now we read the data from the table into arrays

double[] timeStamps = rantable.getCol(0);

double[] highData = rantable.getCol(1);

double[] lowData = rantable.getCol(2);

double[] openData = rantable.getCol(3);

double[] closeData = rantable.getCol(4);

double[] volData = rantable.getCol(5);

// Create a FinanceChart object of width 640 pixels

FinanceChart c = new FinanceChart(640);

// Add a title to the chart

c.addTitle("Finance Chart Demonstration");

// Set the data into the finance chart object

c.setData(timeStamps, highData, lowData, openData, closeData, volData, extraDays);

// Add the main chart with 240 pixels in height

c.addMainChart(240);

// Add a 5 period simple moving average to the main chart, using brown color

c.addSimpleMovingAvg(5, 0x663300);

// Add a 20 period simple moving average to the main chart, using purple color

c.addSimpleMovingAvg(20, 0x9900ff);

// Add HLOC symbols to the main chart, using green/red for up/down days

c.addHLOC(0x008000, 0xcc0000);

// Add 20 days bollinger band to the main chart, using light blue (9999ff) as the border and

// semi-transparent blue (c06666ff) as the fill color

c.addBollingerBand(20, 2, 0x9999ff, unchecked((int)0xc06666ff));

// Add a 75 pixels volume bars sub-chart to the bottom of the main chart, using

// green/red/grey for up/down/flat days

c.addVolBars(75, 0x99ff99, 0xff9999, 0x808080);

// Append a 14-days RSI indicator chart (75 pixels high) after the main chart. The main RSI

// line is purple (800080). Set threshold region to +/- 20 (that is, RSI = 50 +/- 25). The

// upper/lower threshold regions will be filled with red (ff0000)/blue (0000ff).

c.addRSI(75, 14, 0x800080, 20, 0xff0000, 0x0000ff);

// Append a 12-days momentum indicator chart (75 pixels high) using blue (0000ff) color.

c.addMomentum(75, 12, 0x0000ff);

// Output the chart

viewer.Image = c.makeWebImage(Chart.SVG);

}

}

}

[ASP.NET MVC - View] NetMvcCharts\Views\Shared\ChartView.cshtml

@{ Layout = null; }

<!DOCTYPE html>

<html>

<head>

<meta name="viewport" content="width=device-width" />

<title>@ViewBag.Title</title>

<style>

@ViewBag.Style

</style>

@Scripts.Render("~/Scripts/cdjcv.js")

</head>

<body style="margin:5px 0px 0px 5px">

<div style="font:bold 18pt verdana;">

@ViewBag.Title

</div>

<hr style="border:solid 1px #000080; background:#000080" />

<div>

@{

if (ViewBag.Viewer is Array)

{

// Display multiple charts

for (int i = 0; i < ViewBag.Viewer.Length; ++i)

{

@:@Html.Raw(ViewBag.Viewer[i].RenderHTML())

}

}

else

{

// Display one chart only

@:@Html.Raw(ViewBag.Viewer.RenderHTML())

}

}

</div>

</body>

</html>

© 2023 Advanced Software Engineering Limited. All rights reserved.