[ASP.NET Web Forms - C# version] NetWebCharts\CSharpASP\financedemo.aspx

(Click here on how to convert this code to code-behind style.)<%@ Page Language="C#" Debug="true" %>

<%@ Import Namespace="ChartDirector" %>

<%@ Register TagPrefix="chart" Namespace="ChartDirector" Assembly="netchartdir" %>

<script runat="server">

// The timeStamps, volume, high, low, open and close data

DateTime[] timeStamps = null;

double[] volData = null;

double[] highData = null;

double[] lowData = null;

double[] openData = null;

double[] closeData = null;

// An extra data series to compare with the close data

double[] compareData = null;

// The resolution of the data in seconds. 1 day = 86400 seconds.

int resolution = 86400;

/// <summary>

/// Get the timeStamps, highData, lowData, openData, closeData and volData.

/// </summary>

/// <param name="ticker">The ticker symbol for the data series.</param>

/// <param name="startDate">The starting date/time for the data series.</param>

/// <param name="endDate">The ending date/time for the data series.</param>

/// <param name="durationInDays">The number of trading days to get.</param>

/// <param name="extraPoints">The extra leading data points needed in order to

/// compute moving averages.</param>

/// <returns>True if successfully obtain the data, otherwise false.</returns>

protected bool getData(string ticker, DateTime startDate, DateTime endDate, int durationInDays,

int extraPoints)

{

// This method should return false if the ticker symbol is invalid. In this sample code, as we

// are using a random number generator for the data, all ticker symbol is allowed, but we still

// assumed an empty symbol is invalid.

if (ticker == "") {

return false;

}

// In this demo, we can get 15 min, daily, weekly or monthly data depending on the time range.

resolution = 86400;

if (durationInDays <= 10) {

// 10 days or less, we assume 15 minute data points are available

resolution = 900;

// We need to adjust the startDate backwards for the extraPoints. We assume 6.5 hours

// trading time per day, and 5 trading days per week.

double dataPointsPerDay = 6.5 * 3600 / resolution;

DateTime adjustedStartDate = startDate.AddDays(-Math.Ceiling(extraPoints / dataPointsPerDay

* 7 / 5) - 2);

// Get the required 15 min data

get15MinData(ticker, adjustedStartDate, endDate);

} else if (durationInDays >= 4.5 * 360) {

// 4 years or more - use monthly data points.

resolution = 30 * 86400;

// Adjust startDate backwards to cater for extraPoints

DateTime adjustedStartDate = startDate.Date.AddMonths(-extraPoints);

// Get the required monthly data

getMonthlyData(ticker, adjustedStartDate, endDate);

} else if (durationInDays >= 1.5 * 360) {

// 1 year or more - use weekly points.

resolution = 7 * 86400;

// Adjust startDate backwards to cater for extraPoints

DateTime adjustedStartDate = startDate.Date.AddDays(-extraPoints * 7 - 6);

// Get the required weekly data

getWeeklyData(ticker, adjustedStartDate, endDate);

} else {

// Default - use daily points

resolution = 86400;

// Adjust startDate backwards to cater for extraPoints. We multiply the days by 7/5 as we

// assume 1 week has 5 trading days.

DateTime adjustedStartDate = startDate.Date.AddDays(-Math.Ceiling(extraPoints * 7.0 / 5) - 2

);

// Get the required daily data

getDailyData(ticker, adjustedStartDate, endDate);

}

return true;

}

/// <summary>

/// Get 15 minutes data series for timeStamps, highData, lowData, openData, closeData

/// and volData.

/// </summary>

/// <param name="ticker">The ticker symbol for the data series.</param>

/// <param name="startDate">The starting date/time for the data series.</param>

/// <param name="endDate">The ending date/time for the data series.</param>

protected void get15MinData(string ticker, DateTime startDate, DateTime endDate)

{

//

// In this demo, we use a random number generator to generate the data. In practice, you may get

// the data from a database or by other means. If you do not have 15 minute data, you may modify

// the "drawChart" method below to not using 15 minute data.

//

generateRandomData(ticker, startDate, endDate, 900);

}

/// <summary>

/// Get daily data series for timeStamps, highData, lowData, openData, closeData

/// and volData.

/// </summary>

/// <param name="ticker">The ticker symbol for the data series.</param>

/// <param name="startDate">The starting date/time for the data series.</param>

/// <param name="endDate">The ending date/time for the data series.</param>

protected void getDailyData(string ticker, DateTime startDate, DateTime endDate)

{

//

// In this demo, we use a random number generator to generate the data. In practice, you may get

// the data from a database or by other means.

//

// A typical database code example is like below. (This only shows a general idea. The exact

// details may differ depending on your database brand and schema. The SQL, in particular the

// date format, may be different depending on which brand of database you use.)

//

// // Open the database connection to MS SQL

// System.Data.IDbConnection dbconn = new System.Data.SqlClient.SqlConnection(

// "..... put your database connection string here .......");

// dbconn.Open();

//

// // SQL statement to get the data

// System.Data.IDbCommand sqlCmd = dbconn.CreateCommand();

// sqlCmd.CommandText = "Select recordDate, highData, lowData, openData, " +

// "closeData, volData From dailyFinanceTable Where ticker = '" + ticker +

// "' And recordDate >= '" + startDate.ToString("yyyyMMdd") + "' And " +

// "recordDate <= '" + endDate.ToString("yyyyMMdd") + "' Order By recordDate";

//

// // The most convenient way to read the SQL result into arrays is to use the

// // ChartDirector DBTable utility.

// DBTable table = new DBTable(sqlCmd.ExecuteReader());

// dbconn.Close();

//

// // Now get the data into arrays

// timeStamps = table.getColAsDateTime(0);

// highData = table.getCol(1);

// lowData = table.getCol(2);

// openData = table.getCol(3);

// closeData = table.getCol(4);

// volData = table.getCol(5);

//

generateRandomData(ticker, startDate, endDate, 86400);

}

/// <summary>

/// Get weekly data series for timeStamps, highData, lowData, openData, closeData

/// and volData.

/// </summary>

/// <param name="ticker">The ticker symbol for the data series.</param>

/// <param name="startDate">The starting date/time for the data series.</param>

/// <param name="endDate">The ending date/time for the data series.</param>

protected void getWeeklyData(string ticker, DateTime startDate, DateTime endDate)

{

//

// If you do not have weekly data, you may call "getDailyData(startDate, endDate)" to get daily

// data, then call "convertDailyToWeeklyData()" to convert to weekly data.

//

generateRandomData(ticker, startDate, endDate, 86400 * 7);

}

/// <summary>

/// Get monthly data series for timeStamps, highData, lowData, openData, closeData

/// and volData.

/// </summary>

/// <param name="ticker">The ticker symbol for the data series.</param>

/// <param name="startDate">The starting date/time for the data series.</param>

/// <param name="endDate">The ending date/time for the data series.</param>

protected void getMonthlyData(string ticker, DateTime startDate, DateTime endDate)

{

//

// If you do not have weekly data, you may call "getDailyData(startDate, endDate)" to get daily

// data, then call "convertDailyToMonthlyData()" to convert to monthly data.

//

generateRandomData(ticker, startDate, endDate, 86400 * 30);

}

/// <summary>

/// A random number generator designed to generate realistic financial data.

/// </summary>

/// <param name="ticker">The ticker symbol for the data series.</param>

/// <param name="startDate">The starting date/time for the data series.</param>

/// <param name="endDate">The ending date/time for the data series.</param>

/// <param name="resolution">The period of the data series.</param>

protected void generateRandomData(string ticker, DateTime startDate, DateTime endDate,

int resolution)

{

FinanceSimulator db = new FinanceSimulator(ticker, startDate, endDate, resolution);

timeStamps = db.getTimeStamps();

highData = db.getHighData();

lowData = db.getLowData();

openData = db.getOpenData();

closeData = db.getCloseData();

volData = db.getVolData();

}

/// <summary>

/// A utility to convert daily to weekly data.

/// </summary>

protected void convertDailyToWeeklyData()

{

aggregateData(new ArrayMath(timeStamps).selectStartOfWeek());

}

/// <summary>

/// A utility to convert daily to monthly data.

/// </summary>

protected void convertDailyToMonthlyData()

{

aggregateData(new ArrayMath(timeStamps).selectStartOfMonth());

}

/// <summary>

/// An internal method used to aggregate daily data.

/// </summary>

protected void aggregateData(ArrayMath aggregator)

{

timeStamps = Chart.NTime(aggregator.aggregate(Chart.CTime(timeStamps), Chart.AggregateFirst));

highData = aggregator.aggregate(highData, Chart.AggregateMax);

lowData = aggregator.aggregate(lowData, Chart.AggregateMin);

openData = aggregator.aggregate(openData, Chart.AggregateFirst);

closeData = aggregator.aggregate(closeData, Chart.AggregateLast);

volData = aggregator.aggregate(volData, Chart.AggregateSum);

}

/// <summary>

/// Create a financial chart according to user selections. The user selections are

/// encoded in the query parameters.

/// </summary>

public BaseChart drawChart()

{

// In this demo, we just assume we plot up to the latest time. So end date is now.

DateTime endDate = DateTime.Now;

// If the trading day has not yet started (before 9:30am), or if the end date is on on Sat or

// Sun, we set the end date to 4:00pm of the last trading day

while ((endDate.TimeOfDay.CompareTo(new TimeSpan(9, 30, 0)) < 0) || (endDate.DayOfWeek ==

DayOfWeek.Sunday) || (endDate.DayOfWeek == DayOfWeek.Saturday)) {

endDate = endDate.Date.AddDays(-1).Add(new TimeSpan(16, 0, 0));

}

// The duration selected by the user

int durationInDays = int.Parse(TimeRange.SelectedItem.Value);

// Compute the start date by subtracting the duration from the end date.

DateTime startDate = endDate;

if (durationInDays >= 30) {

// More or equal to 30 days - so we use months as the unit

startDate = new DateTime(endDate.Year, endDate.Month, 1).AddMonths(-durationInDays / 30);

} else {

// Less than 30 days - use day as the unit. The starting point of the axis is always at the

// start of the day (9:30am). Note that we use trading days, so we skip Sat and Sun in

// counting the days.

startDate = endDate.Date;

for(int i = 1; i < durationInDays; ++i) {

if (startDate.DayOfWeek == DayOfWeek.Monday) {

startDate = startDate.AddDays(-3);

} else {

startDate = startDate.AddDays(-1);

}

}

}

// The moving average periods selected by the user.

int avgPeriod1 = 0;

int.TryParse(movAvg1.Text, out avgPeriod1);

int avgPeriod2 = 0;

int.TryParse(movAvg2.Text, out avgPeriod2);

if (avgPeriod1 < 0) {

avgPeriod1 = 0;

} else if (avgPeriod1 > 300) {

avgPeriod1 = 300;

}

if (avgPeriod2 < 0) {

avgPeriod2 = 0;

} else if (avgPeriod2 > 300) {

avgPeriod2 = 300;

}

// We need extra leading data points in order to compute moving averages.

int extraPoints = 20;

if (avgPeriod1 > extraPoints) {

extraPoints = avgPeriod1;

}

if (avgPeriod2 > extraPoints) {

extraPoints = avgPeriod2;

}

// Get the data series to compare with, if any.

string compareKey = CompareWith.Text.Trim();

compareData = null;

if (getData(compareKey, startDate, endDate, durationInDays, extraPoints)) {

compareData = closeData;

}

// The data series we want to get.

string tickerKey = TickerSymbol.Text.Trim();

if (!getData(tickerKey, startDate, endDate, durationInDays, extraPoints)) {

return errMsg("Please enter a valid ticker symbol");

}

// We now confirm the actual number of extra points (data points that are before the start date)

// as inferred using actual data from the database.

extraPoints = timeStamps.Length;

for(int i = 0; i < timeStamps.Length; ++i) {

if (timeStamps[i] >= startDate) {

extraPoints = i;

break;

}

}

// Check if there is any valid data

if (extraPoints >= timeStamps.Length) {

// No data - just display the no data message.

return errMsg("No data available for the specified time period");

}

// In some finance chart presentation style, even if the data for the latest day is not fully

// available, the axis for the entire day will still be drawn, where no data will appear near

// the end of the axis.

if (resolution < 86400) {

// Add extra points to the axis until it reaches the end of the day. The end of day is

// assumed to be 16:00 (it depends on the stock exchange).

DateTime lastTime = timeStamps[timeStamps.Length - 1];

int extraTrailingPoints = (int)(new TimeSpan(16, 0, 0).Subtract(lastTime.TimeOfDay

).TotalSeconds / resolution);

if (extraTrailingPoints > 0) {

DateTime[] extendedTimeStamps = new DateTime[timeStamps.Length + extraTrailingPoints];

Array.Copy(timeStamps, 0, extendedTimeStamps, 0, timeStamps.Length);

for(int i = 0; i < extraTrailingPoints; ++i) {

extendedTimeStamps[i + timeStamps.Length] = lastTime.AddSeconds(resolution * (i + 1)

);

}

timeStamps = extendedTimeStamps;

}

}

//

// At this stage, all data are available. We can draw the chart as according to user input.

//

//

// Determine the chart size. In this demo, user can select 4 different chart sizes. Default is

// the large chart size.

//

int width = 780;

int mainHeight = 255;

int indicatorHeight = 80;

string size = ChartSize.SelectedItem.Value;

if (size == "S") {

// Small chart size

width = 450;

mainHeight = 160;

indicatorHeight = 60;

} else if (size == "M") {

// Medium chart size

width = 620;

mainHeight = 215;

indicatorHeight = 70;

} else if (size == "H") {

// Huge chart size

width = 1000;

mainHeight = 320;

indicatorHeight = 90;

}

// Create the chart object using the selected size

FinanceChart m = new FinanceChart(width);

// Set the data into the chart object

m.setData(timeStamps, highData, lowData, openData, closeData, volData, extraPoints);

//

// We configure the title of the chart. In this demo chart design, we put the company name as

// the top line of the title with left alignment.

//

m.addPlotAreaTitle(Chart.TopLeft, tickerKey);

// We displays the current date as well as the data resolution on the next line.

string resolutionText = "";

if (resolution == 30 * 86400) {

resolutionText = "Monthly";

} else if (resolution == 7 * 86400) {

resolutionText = "Weekly";

} else if (resolution == 86400) {

resolutionText = "Daily";

} else if (resolution == 900) {

resolutionText = "15-min";

}

m.addPlotAreaTitle(Chart.BottomLeft, "<*font=Arial,size=8*>" + m.formatValue(DateTime.Now,

"mmm dd, yyyy") + " - " + resolutionText + " chart");

// A copyright message at the bottom left corner the title area

m.addPlotAreaTitle(Chart.BottomRight, "<*font=Arial,size=8*>(c) Advanced Software Engineering");

//

// Add the first techical indicator according. In this demo, we draw the first indicator on top

// of the main chart.

//

addIndicator(m, Indicator1.SelectedItem.Value, indicatorHeight);

//

// Add the main chart

//

m.addMainChart(mainHeight);

//

// Set log or linear scale according to user preference

//

if (LogScale.Checked) {

m.setLogScale(true);

}

//

// Set axis labels to show data values or percentage change to user preference

//

if (PercentageScale.Checked) {

m.setPercentageAxis();

}

//

// Draw any price line the user has selected

//

string mainType = ChartType.SelectedItem.Value;

if (mainType == "Close") {

m.addCloseLine(0x000040);

} else if (mainType == "TP") {

m.addTypicalPrice(0x000040);

} else if (mainType == "WC") {

m.addWeightedClose(0x000040);

} else if (mainType == "Median") {

m.addMedianPrice(0x000040);

}

//

// Add comparison line if there is data for comparison

//

if (compareData != null) {

if (compareData.Length > extraPoints) {

m.addComparison(compareData, 0x0000ff, compareKey);

}

}

//

// Add moving average lines.

//

addMovingAvg(m, avgType1.SelectedItem.Value, avgPeriod1, 0x663300);

addMovingAvg(m, avgType2.SelectedItem.Value, avgPeriod2, 0x9900ff);

//

// Draw candlesticks or OHLC symbols if the user has selected them.

//

if (mainType == "CandleStick") {

m.addCandleStick(0x33ff33, 0xff3333);

} else if (mainType == "OHLC") {

m.addHLOC(0x008800, 0xcc0000);

}

//

// Add parabolic SAR if necessary

//

if (ParabolicSAR.Checked) {

m.addParabolicSAR(0.02, 0.02, 0.2, Chart.DiamondShape, 5, 0x008800, 0x000000);

}

//

// Add price band/channel/envelop to the chart according to user selection

//

string bandType = Band.SelectedItem.Value;

if (bandType == "BB") {

m.addBollingerBand(20, 2, 0x9999ff, unchecked((int)0xc06666ff));

} else if (bandType == "DC") {

m.addDonchianChannel(20, 0x9999ff, unchecked((int)0xc06666ff));

} else if (bandType == "Envelop") {

m.addEnvelop(20, 0.1, 0x9999ff, unchecked((int)0xc06666ff));

}

//

// Add volume bars to the main chart if necessary

//

if (Volume.Checked) {

m.addVolBars(indicatorHeight, 0x99ff99, 0xff9999, 0xc0c0c0);

}

//

// Add additional indicators as according to user selection.

//

addIndicator(m, Indicator2.SelectedItem.Value, indicatorHeight);

addIndicator(m, Indicator3.SelectedItem.Value, indicatorHeight);

addIndicator(m, Indicator4.SelectedItem.Value, indicatorHeight);

return m;

}

/// <summary>

/// Add a moving average line to the FinanceChart object.

/// </summary>

/// <param name="m">The FinanceChart object to add the line to.</param>

/// <param name="avgType">The moving average type (SMA/EMA/TMA/WMA).</param>

/// <param name="avgPeriod">The moving average period.</param>

/// <param name="color">The color of the line.</param>

/// <returns>The LineLayer object representing line layer created.</returns>

protected LineLayer addMovingAvg(FinanceChart m, string avgType, int avgPeriod, int color)

{

if (avgPeriod > 1) {

if (avgType == "SMA") {

return m.addSimpleMovingAvg(avgPeriod, color);

} else if (avgType == "EMA") {

return m.addExpMovingAvg(avgPeriod, color);

} else if (avgType == "TMA") {

return m.addTriMovingAvg(avgPeriod, color);

} else if (avgType == "WMA") {

return m.addWeightedMovingAvg(avgPeriod, color);

}

}

return null;

}

/// <summary>

/// Add an indicator chart to the FinanceChart object. In this demo example, the

/// indicator parameters (such as the period used to compute RSI, colors of the lines,

/// etc.) are hard coded to commonly used values. You are welcome to design a more

/// complex user interface to allow users to set the parameters.

/// </summary>

/// <param name="m">The FinanceChart object to add the line to.</param>

/// <param name="indicator">The selected indicator.</param>

/// <param name="height">Height of the chart in pixels</param>

/// <returns>The XYChart object representing indicator chart.</returns>

protected XYChart addIndicator(FinanceChart m, string indicator, int height)

{

if (indicator == "RSI") {

return m.addRSI(height, 14, 0x800080, 20, 0xff6666, 0x6666ff);

} else if (indicator == "StochRSI") {

return m.addStochRSI(height, 14, 0x800080, 30, 0xff6666, 0x6666ff);

} else if (indicator == "MACD") {

return m.addMACD(height, 26, 12, 9, 0x0000ff, 0xff00ff, 0x008000);

} else if (indicator == "FStoch") {

return m.addFastStochastic(height, 14, 3, 0x006060, 0x606000);

} else if (indicator == "SStoch") {

return m.addSlowStochastic(height, 14, 3, 0x006060, 0x606000);

} else if (indicator == "ATR") {

return m.addATR(height, 14, 0x808080, 0x0000ff);

} else if (indicator == "ADX") {

return m.addADX(height, 14, 0x008000, 0x800000, 0x000080);

} else if (indicator == "DCW") {

return m.addDonchianWidth(height, 20, 0x0000ff);

} else if (indicator == "BBW") {

return m.addBollingerWidth(height, 20, 2, 0x0000ff);

} else if (indicator == "DPO") {

return m.addDPO(height, 20, 0x0000ff);

} else if (indicator == "PVT") {

return m.addPVT(height, 0x0000ff);

} else if (indicator == "Momentum") {

return m.addMomentum(height, 12, 0x0000ff);

} else if (indicator == "Performance") {

return m.addPerformance(height, 0x0000ff);

} else if (indicator == "ROC") {

return m.addROC(height, 12, 0x0000ff);

} else if (indicator == "OBV") {

return m.addOBV(height, 0x0000ff);

} else if (indicator == "AccDist") {

return m.addAccDist(height, 0x0000ff);

} else if (indicator == "CLV") {

return m.addCLV(height, 0x0000ff);

} else if (indicator == "WilliamR") {

return m.addWilliamR(height, 14, 0x800080, 30, 0xff6666, 0x6666ff);

} else if (indicator == "Aroon") {

return m.addAroon(height, 14, 0x339933, 0x333399);

} else if (indicator == "AroonOsc") {

return m.addAroonOsc(height, 14, 0x0000ff);

} else if (indicator == "CCI") {

return m.addCCI(height, 20, 0x800080, 100, 0xff6666, 0x6666ff);

} else if (indicator == "EMV") {

return m.addEaseOfMovement(height, 9, 0x006060, 0x606000);

} else if (indicator == "MDX") {

return m.addMassIndex(height, 0x800080, 0xff6666, 0x6666ff);

} else if (indicator == "CVolatility") {

return m.addChaikinVolatility(height, 10, 10, 0x0000ff);

} else if (indicator == "COscillator") {

return m.addChaikinOscillator(height, 0x0000ff);

} else if (indicator == "CMF") {

return m.addChaikinMoneyFlow(height, 21, 0x008000);

} else if (indicator == "NVI") {

return m.addNVI(height, 255, 0x0000ff, 0x883333);

} else if (indicator == "PVI") {

return m.addPVI(height, 255, 0x0000ff, 0x883333);

} else if (indicator == "MFI") {

return m.addMFI(height, 14, 0x800080, 30, 0xff6666, 0x6666ff);

} else if (indicator == "PVO") {

return m.addPVO(height, 26, 12, 9, 0x0000ff, 0xff00ff, 0x008000);

} else if (indicator == "PPO") {

return m.addPPO(height, 26, 12, 9, 0x0000ff, 0xff00ff, 0x008000);

} else if (indicator == "UO") {

return m.addUltimateOscillator(height, 7, 14, 28, 0x800080, 20, 0xff6666, 0x6666ff);

} else if (indicator == "Vol") {

return m.addVolIndicator(height, 0x99ff99, 0xff9999, 0xc0c0c0);

} else if (indicator == "TRIX") {

return m.addTRIX(height, 12, 0x0000ff);

}

return null;

}

/// <summary>

/// Creates a dummy chart to show an error message.

/// </summary>

/// <param name="msg">The error message.

/// <returns>The BaseChart object containing the error message.</returns>

protected BaseChart errMsg(string msg)

{

MultiChart m = new MultiChart(400, 200);

m.addTitle2(Chart.Center, msg, "Arial", 10).setMaxWidth(m.getWidth());

return m;

}

//

// Page Load event handler

//

protected void Page_Load(object sender, EventArgs e)

{

// Create the finance chart

BaseChart c = drawChart();

// Output the chart

WebChartViewer1.Image = c.makeWebImage(Chart.SVG);

}

</script>

<!DOCTYPE html>

<html>

<head>

<title>ChartDirector Financial Chart Demonstration</title>

<style>

.inputtitle {font:11px verdana; margin:10px 5px;}

.input {font:11px verdana}

</style>

</head>

<body style="margin:0px">

<table style="border:0px; padding:0px; border-spacing:0px;">

<tr>

<td align="right" colspan="2" style="background:#000088">

<div style="padding:0px 3px 2px 0px; font:bold italic 10pt arial;">

<a style="color:#ffff00; text-decoration:none" href="http://www.advsofteng.com">

Advanced Software Engineering

</a>

</div>

</td>

</tr>

<tr valign="top">

<td style="width:150px; background:#bbddff">

<form id="Form1" method="post" runat="server">

<div class="inputtitle">

<b>Ticker Symbol</b><br />

<asp:TextBox runat="server" id="TickerSymbol" class="input" style="width:140px;">ASE.SYMBOL</asp:TextBox>

</div>

<div class="inputtitle">

<b>Compare With</b><br />

<asp:TextBox runat="server" id="CompareWith" class="input" style="width:140px;"></asp:TextBox>

</div>

<div class="inputtitle">

<b>Time Period</b><br />

<asp:DropDownList runat="server" id="TimeRange" class="input" style="width:140px;">

<asp:ListItem value="1">1 day</asp:ListItem>

<asp:ListItem value="2">2 days</asp:ListItem>

<asp:ListItem value="5">5 days</asp:ListItem>

<asp:ListItem value="10">10 days</asp:ListItem>

<asp:ListItem value="30">1 month</asp:ListItem>

<asp:ListItem value="60">2 months</asp:ListItem>

<asp:ListItem value="90">3 months</asp:ListItem>

<asp:ListItem value="180" Selected="True">6 months</asp:ListItem>

<asp:ListItem value="360">1 year</asp:ListItem>

<asp:ListItem value="720">2 years</asp:ListItem>

<asp:ListItem value="1080">3 years</asp:ListItem>

<asp:ListItem value="1440">4 years</asp:ListItem>

<asp:ListItem value="1800">5 years</asp:ListItem>

<asp:ListItem value="3600">10 years</asp:ListItem>

</asp:DropDownList>

</div>

<div class="inputtitle">

<b>Chart Size</b><br />

<asp:DropDownList runat="server" id="ChartSize" class="input" style="width:140px;">

<asp:ListItem value="S">Small</asp:ListItem>

<asp:ListItem value="M">Medium</asp:ListItem>

<asp:ListItem value="L" Selected="True">Large</asp:ListItem>

<asp:ListItem value="H">Huge</asp:ListItem>

</asp:DropDownList><br />

</div>

<div class="inputtitle">

<asp:CheckBox runat="server" Text="Show Volume Bars" id="Volume" Checked="True"></asp:CheckBox><br />

<asp:CheckBox runat="server" Text="Parabolic SAR" id="ParabolicSAR"></asp:CheckBox><br />

<asp:CheckBox runat="server" Text="Log Scale" id="LogScale"></asp:CheckBox><br />

<asp:CheckBox runat="server" Text="Percentage Scale" id="PercentageScale"></asp:CheckBox><br />

</div>

<div class="inputtitle">

<b>Chart Type</b><br />

<asp:DropDownList runat="server" id="ChartType" class="input" style="width:140px;">

<asp:ListItem value="None">None</asp:ListItem>

<asp:ListItem value="CandleStick" Selected="True">CandleStick</asp:ListItem>

<asp:ListItem value="Close">Closing Price</asp:ListItem>

<asp:ListItem value="Median">Median Price</asp:ListItem>

<asp:ListItem value="OHLC">OHLC</asp:ListItem>

<asp:ListItem value="TP">Typical Price</asp:ListItem>

<asp:ListItem value="WC">Weighted Close</asp:ListItem>

</asp:DropDownList>

</div>

<div class="inputtitle">

<b>Price Band</b><br />

<asp:DropDownList runat="server" id="Band" class="input" style="width:140px;">

<asp:ListItem value="None">None</asp:ListItem>

<asp:ListItem value="BB" Selected="True">Bollinger Band</asp:ListItem>

<asp:ListItem value="DC">Donchian Channel</asp:ListItem>

<asp:ListItem value="Envelop">Envelop (SMA 20 +/- 10%)</asp:ListItem>

</asp:DropDownList>

</div>

<div class="inputtitle">

<b>Moving Averages</b><br />

<asp:DropDownList runat="server" id="avgType1" class="input" style="width:105px;">

<asp:ListItem value="None">None</asp:ListItem>

<asp:ListItem value="SMA" Selected="True">Simple</asp:ListItem>

<asp:ListItem value="EMA">Exponential</asp:ListItem>

<asp:ListItem value="TMA">Triangular</asp:ListItem>

<asp:ListItem value="WMA">Weighted</asp:ListItem>

</asp:DropDownList>

<asp:TextBox runat="server" id="movAvg1" class="input" style="width:30px;">10</asp:TextBox><br />

<asp:DropDownList runat="server" id="avgType2" class="input" style="width:105px;">

<asp:ListItem value="None">None</asp:ListItem>

<asp:ListItem value="SMA" Selected="True">Simple</asp:ListItem>

<asp:ListItem value="EMA">Exponential</asp:ListItem>

<asp:ListItem value="TMA">Triangular</asp:ListItem>

<asp:ListItem value="WMA">Weighted</asp:ListItem>

</asp:DropDownList>

<asp:TextBox runat="server" id="movAvg2" class="input" style="width:30px;">25</asp:TextBox><br />

</div>

<div class="inputtitle">

<b>Technical Indicators</b><br />

<asp:DropDownList runat="server" id="Indicator1" class="input" style="width:140px;">

<asp:ListItem value="None">None</asp:ListItem>

<asp:ListItem value="AccDist">Accumulation/Distribution</asp:ListItem>

<asp:ListItem value="AroonOsc">Aroon Oscillator</asp:ListItem>

<asp:ListItem value="Aroon">Aroon Up/Down</asp:ListItem>

<asp:ListItem value="ADX">Avg Directional Index</asp:ListItem>

<asp:ListItem value="ATR">Avg True Range</asp:ListItem>

<asp:ListItem value="BBW">Bollinger Band Width</asp:ListItem>

<asp:ListItem value="CMF">Chaikin Money Flow</asp:ListItem>

<asp:ListItem value="COscillator">Chaikin Oscillator</asp:ListItem>

<asp:ListItem value="CVolatility">Chaikin Volatility</asp:ListItem>

<asp:ListItem value="CLV">Close Location Value</asp:ListItem>

<asp:ListItem value="CCI">Commodity Channel Index</asp:ListItem>

<asp:ListItem value="DPO">Detrended Price Osc</asp:ListItem>

<asp:ListItem value="DCW">Donchian Channel Width</asp:ListItem>

<asp:ListItem value="EMV">Ease of Movement</asp:ListItem>

<asp:ListItem value="FStoch">Fast Stochastic</asp:ListItem>

<asp:ListItem value="MACD">MACD</asp:ListItem>

<asp:ListItem value="MDX">Mass Index</asp:ListItem>

<asp:ListItem value="Momentum">Momentum</asp:ListItem>

<asp:ListItem value="MFI">Money Flow Index</asp:ListItem>

<asp:ListItem value="NVI">Neg Volume Index</asp:ListItem>

<asp:ListItem value="OBV">On Balance Volume</asp:ListItem>

<asp:ListItem value="Performance">Performance</asp:ListItem>

<asp:ListItem value="PPO">% Price Oscillator</asp:ListItem>

<asp:ListItem value="PVO">% Volume Oscillator</asp:ListItem>

<asp:ListItem value="PVI">Pos Volume Index</asp:ListItem>

<asp:ListItem value="PVT">Price Volume Trend</asp:ListItem>

<asp:ListItem value="ROC">Rate of Change</asp:ListItem>

<asp:ListItem value="RSI" Selected="True">RSI</asp:ListItem>

<asp:ListItem value="SStoch">Slow Stochastic</asp:ListItem>

<asp:ListItem value="StochRSI">StochRSI</asp:ListItem>

<asp:ListItem value="TRIX">TRIX</asp:ListItem>

<asp:ListItem value="UO">Ultimate Oscillator</asp:ListItem>

<asp:ListItem value="Vol">Volume</asp:ListItem>

<asp:ListItem value="WilliamR">William's %R</asp:ListItem>

</asp:DropDownList><br />

<asp:DropDownList runat="server" id="Indicator2" class="input" style="width:140px;">

<asp:ListItem value="None">None</asp:ListItem>

<asp:ListItem value="AccDist">Accumulation/Distribution</asp:ListItem>

<asp:ListItem value="AroonOsc">Aroon Oscillator</asp:ListItem>

<asp:ListItem value="Aroon">Aroon Up/Down</asp:ListItem>

<asp:ListItem value="ADX">Avg Directional Index</asp:ListItem>

<asp:ListItem value="ATR">Avg True Range</asp:ListItem>

<asp:ListItem value="BBW">Bollinger Band Width</asp:ListItem>

<asp:ListItem value="CMF">Chaikin Money Flow</asp:ListItem>

<asp:ListItem value="COscillator">Chaikin Oscillator</asp:ListItem>

<asp:ListItem value="CVolatility">Chaikin Volatility</asp:ListItem>

<asp:ListItem value="CLV">Close Location Value</asp:ListItem>

<asp:ListItem value="CCI">Commodity Channel Index</asp:ListItem>

<asp:ListItem value="DPO">Detrended Price Osc</asp:ListItem>

<asp:ListItem value="DCW">Donchian Channel Width</asp:ListItem>

<asp:ListItem value="EMV">Ease of Movement</asp:ListItem>

<asp:ListItem value="FStoch">Fast Stochastic</asp:ListItem>

<asp:ListItem value="MACD" Selected="True">MACD</asp:ListItem>

<asp:ListItem value="MDX">Mass Index</asp:ListItem>

<asp:ListItem value="Momentum">Momentum</asp:ListItem>

<asp:ListItem value="MFI">Money Flow Index</asp:ListItem>

<asp:ListItem value="NVI">Neg Volume Index</asp:ListItem>

<asp:ListItem value="OBV">On Balance Volume</asp:ListItem>

<asp:ListItem value="Performance">Performance</asp:ListItem>

<asp:ListItem value="PPO">% Price Oscillator</asp:ListItem>

<asp:ListItem value="PVO">% Volume Oscillator</asp:ListItem>

<asp:ListItem value="PVI">Pos Volume Index</asp:ListItem>

<asp:ListItem value="PVT">Price Volume Trend</asp:ListItem>

<asp:ListItem value="ROC">Rate of Change</asp:ListItem>

<asp:ListItem value="RSI">RSI</asp:ListItem>

<asp:ListItem value="SStoch">Slow Stochastic</asp:ListItem>

<asp:ListItem value="StochRSI">StochRSI</asp:ListItem>

<asp:ListItem value="TRIX">TRIX</asp:ListItem>

<asp:ListItem value="UO">Ultimate Oscillator</asp:ListItem>

<asp:ListItem value="Vol">Volume</asp:ListItem>

<asp:ListItem value="WilliamR">William's %R</asp:ListItem>

</asp:DropDownList><br />

<asp:DropDownList runat="server" id="Indicator3" class="input" style="width:140px;">

<asp:ListItem value="None" Selected="True">None</asp:ListItem>

<asp:ListItem value="AccDist">Accumulation/Distribution</asp:ListItem>

<asp:ListItem value="AroonOsc">Aroon Oscillator</asp:ListItem>

<asp:ListItem value="Aroon">Aroon Up/Down</asp:ListItem>

<asp:ListItem value="ADX">Avg Directional Index</asp:ListItem>

<asp:ListItem value="ATR">Avg True Range</asp:ListItem>

<asp:ListItem value="BBW">Bollinger Band Width</asp:ListItem>

<asp:ListItem value="CMF">Chaikin Money Flow</asp:ListItem>

<asp:ListItem value="COscillator">Chaikin Oscillator</asp:ListItem>

<asp:ListItem value="CVolatility">Chaikin Volatility</asp:ListItem>

<asp:ListItem value="CLV">Close Location Value</asp:ListItem>

<asp:ListItem value="CCI">Commodity Channel Index</asp:ListItem>

<asp:ListItem value="DPO">Detrended Price Osc</asp:ListItem>

<asp:ListItem value="DCW">Donchian Channel Width</asp:ListItem>

<asp:ListItem value="EMV">Ease of Movement</asp:ListItem>

<asp:ListItem value="FStoch">Fast Stochastic</asp:ListItem>

<asp:ListItem value="MACD">MACD</asp:ListItem>

<asp:ListItem value="MDX">Mass Index</asp:ListItem>

<asp:ListItem value="Momentum">Momentum</asp:ListItem>

<asp:ListItem value="MFI">Money Flow Index</asp:ListItem>

<asp:ListItem value="NVI">Neg Volume Index</asp:ListItem>

<asp:ListItem value="OBV">On Balance Volume</asp:ListItem>

<asp:ListItem value="Performance">Performance</asp:ListItem>

<asp:ListItem value="PPO">% Price Oscillator</asp:ListItem>

<asp:ListItem value="PVO">% Volume Oscillator</asp:ListItem>

<asp:ListItem value="PVI">Pos Volume Index</asp:ListItem>

<asp:ListItem value="PVT">Price Volume Trend</asp:ListItem>

<asp:ListItem value="ROC">Rate of Change</asp:ListItem>

<asp:ListItem value="RSI">RSI</asp:ListItem>

<asp:ListItem value="SStoch">Slow Stochastic</asp:ListItem>

<asp:ListItem value="StochRSI">StochRSI</asp:ListItem>

<asp:ListItem value="TRIX">TRIX</asp:ListItem>

<asp:ListItem value="UO">Ultimate Oscillator</asp:ListItem>

<asp:ListItem value="Vol">Volume</asp:ListItem>

<asp:ListItem value="WilliamR">William's %R</asp:ListItem>

</asp:DropDownList><br />

<asp:DropDownList runat="server" id="Indicator4" class="input" style="width:140px;">

<asp:ListItem value="None" Selected="True">None</asp:ListItem>

<asp:ListItem value="AccDist">Accumulation/Distribution</asp:ListItem>

<asp:ListItem value="AroonOsc">Aroon Oscillator</asp:ListItem>

<asp:ListItem value="Aroon">Aroon Up/Down</asp:ListItem>

<asp:ListItem value="ADX">Avg Directional Index</asp:ListItem>

<asp:ListItem value="ATR">Avg True Range</asp:ListItem>

<asp:ListItem value="BBW">Bollinger Band Width</asp:ListItem>

<asp:ListItem value="CMF">Chaikin Money Flow</asp:ListItem>

<asp:ListItem value="COscillator">Chaikin Oscillator</asp:ListItem>

<asp:ListItem value="CVolatility">Chaikin Volatility</asp:ListItem>

<asp:ListItem value="CLV">Close Location Value</asp:ListItem>

<asp:ListItem value="CCI">Commodity Channel Index</asp:ListItem>

<asp:ListItem value="DPO">Detrended Price Osc</asp:ListItem>

<asp:ListItem value="DCW">Donchian Channel Width</asp:ListItem>

<asp:ListItem value="EMV">Ease of Movement</asp:ListItem>

<asp:ListItem value="FStoch">Fast Stochastic</asp:ListItem>

<asp:ListItem value="MACD">MACD</asp:ListItem>

<asp:ListItem value="MDX">Mass Index</asp:ListItem>

<asp:ListItem value="Momentum">Momentum</asp:ListItem>

<asp:ListItem value="MFI">Money Flow Index</asp:ListItem>

<asp:ListItem value="NVI">Neg Volume Index</asp:ListItem>

<asp:ListItem value="OBV">On Balance Volume</asp:ListItem>

<asp:ListItem value="Performance">Performance</asp:ListItem>

<asp:ListItem value="PPO">% Price Oscillator</asp:ListItem>

<asp:ListItem value="PVO">% Volume Oscillator</asp:ListItem>

<asp:ListItem value="PVI">Pos Volume Index</asp:ListItem>

<asp:ListItem value="PVT">Price Volume Trend</asp:ListItem>

<asp:ListItem value="ROC">Rate of Change</asp:ListItem>

<asp:ListItem value="RSI">RSI</asp:ListItem>

<asp:ListItem value="SStoch">Slow Stochastic</asp:ListItem>

<asp:ListItem value="StochRSI">StochRSI</asp:ListItem>

<asp:ListItem value="TRIX">TRIX</asp:ListItem>

<asp:ListItem value="UO">Ultimate Oscillator</asp:ListItem>

<asp:ListItem value="Vol">Volume</asp:ListItem>

<asp:ListItem value="WilliamR">William's %R</asp:ListItem>

</asp:DropDownList>

</div>

<div class="inputtitle" style="text-align:center">

<asp:Button runat="server" id="Button1" class="input" Text="Update Chart"></asp:Button>

</div>

</form>

</td>

<td>

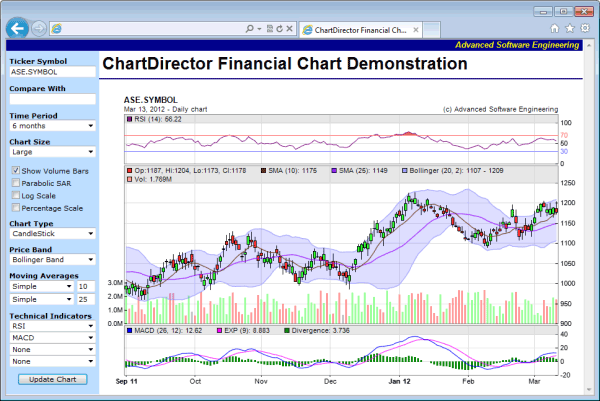

<div style="font:bold 20pt arial; margin:5px 0px 0px 5px">

ChartDirector Financial Chart Demonstration

</div>

<hr style="border:solid 1px #000080" />

<br />

<chart:webchartviewer id="WebChartViewer1" runat="server" ImageAlign="Top" />

</td>

</tr>

</table>

</body>

</html>

[ASP.NET Web Forms - VB Version] NetWebCharts\VBNetASP\financedemo.aspx

(Click here on how to convert this code to code-behind style.)<%@ Page Language="VB" Debug="true" %>

<%@ Import Namespace="ChartDirector" %>

<%@ Register TagPrefix="chart" Namespace="ChartDirector" Assembly="netchartdir" %>

<script runat="server">

' The timeStamps, volume, high, low, open and close data

Dim timeStamps() As Date = Nothing

Dim volData() As Double = Nothing

Dim highData() As Double = Nothing

Dim lowData() As Double = Nothing

Dim openData() As Double = Nothing

Dim closeData() As Double = Nothing

' An extra data series to compare with the close data

Dim compareData() As Double = Nothing

' The resolution of the data in seconds. 1 day = 86400 seconds.

Dim resolution As Integer = 86400

'/ <summary>

'/ Get the timeStamps, highData, lowData, openData, closeData and volData.

'/ </summary>

'/ <param name="ticker">The ticker symbol for the data series.</param>

'/ <param name="startDate">The starting date/time for the data series.</param>

'/ <param name="endDate">The ending date/time for the data series.</param>

'/ <param name="durationInDays">The number of trading days to get.</param>

'/ <param name="extraPoints">The extra leading data points needed in order to

'/ compute moving averages.</param>

'/ <returns>True if successfully obtain the data, otherwise false.</returns>

Protected Function getData(ticker As String, startDate As Date, endDate As Date, _

durationInDays As Integer, extraPoints As Integer) As Boolean

' This method should return false if the ticker symbol is invalid. In this sample code, as we

' are using a random number generator for the data, all ticker symbol is allowed, but we still

' assumed an empty symbol is invalid.

If ticker = "" Then

Return False

End If

' In this demo, we can get 15 min, daily, weekly or monthly data depending on the time range.

resolution = 86400

If durationInDays <= 10 Then

' 10 days or less, we assume 15 minute data points are available

resolution = 900

' We need to adjust the startDate backwards for the extraPoints. We assume 6.5 hours trading

' time per day, and 5 trading days per week.

Dim dataPointsPerDay As Double = 6.5 * 3600 / resolution

Dim adjustedStartDate As Date = startDate.AddDays(-Math.Ceiling(extraPoints / _

dataPointsPerDay * 7 / 5) - 2)

' Get the required 15 min data

get15MinData(ticker, adjustedStartDate, endDate)

ElseIf durationInDays >= 4.5 * 360 Then

' 4 years or more - use monthly data points.

resolution = 30 * 86400

' Adjust startDate backwards to cater for extraPoints

Dim adjustedStartDate As Date = startDate.Date.AddMonths(-extraPoints)

' Get the required monthly data

getMonthlyData(ticker, adjustedStartDate, endDate)

ElseIf durationInDays >= 1.5 * 360 Then

' 1 year or more - use weekly points.

resolution = 7 * 86400

' Adjust startDate backwards to cater for extraPoints

Dim adjustedStartDate As Date = startDate.Date.AddDays(-extraPoints * 7 - 6)

' Get the required weekly data

getWeeklyData(ticker, adjustedStartDate, endDate)

Else

' Default - use daily points

resolution = 86400

' Adjust startDate backwards to cater for extraPoints. We multiply the days by 7/5 as we

' assume 1 week has 5 trading days.

Dim adjustedStartDate As Date = startDate.Date.AddDays(-Math.Ceiling(extraPoints * 7.0 / 5 _

) - 2)

' Get the required daily data

getDailyData(ticker, adjustedStartDate, endDate)

End If

Return True

End Function

'/ <summary>

'/ Get 15 minutes data series for timeStamps, highData, lowData, openData, closeData

'/ and volData.

'/ </summary>

'/ <param name="ticker">The ticker symbol for the data series.</param>

'/ <param name="startDate">The starting date/time for the data series.</param>

'/ <param name="endDate">The ending date/time for the data series.</param>

Protected Sub get15MinData(ticker As String, startDate As Date, endDate As Date)

'

' In this demo, we use a random number generator to generate the data. In practice, you may get

' the data from a database or by other means. If you do not have 15 minute data, you may modify

' the "drawChart" method below to not using 15 minute data.

'

generateRandomData(ticker, startDate, endDate, 900)

End Sub

'/ <summary>

'/ Get daily data series for timeStamps, highData, lowData, openData, closeData

'/ and volData.

'/ </summary>

'/ <param name="ticker">The ticker symbol for the data series.</param>

'/ <param name="startDate">The starting date/time for the data series.</param>

'/ <param name="endDate">The ending date/time for the data series.</param>

Protected Sub getDailyData(ticker As String, startDate As Date, endDate As Date)

'

' In this demo, we use a random number generator to generate the data. In practice, you may get

' the data from a database or by other means.

'

' A typical database code example is like below. (This only shows a general idea. The exact

' details may differ depending on your database brand and schema. The SQL, in particular the

' date format, may be different depending on which brand of database you use.)

'

' ' Open the database connection to MS SQL

' Dim dbconn As System.Data.IDbConnection = New System.Data.SqlClient.SqlConnection(

' "..... put your database connection string here .......")

' dbconn.Open()

'

' ' SQL statement to get the data

' Dim sqlCmd As System.Data.IDbCommand = dbconn.CreateCommand()

' sqlCmd.CommandText = "Select recordDate, highData, lowData, openData, " & _

' "closeData, volData From dailyFinanceTable Where ticker = '" & ticker & _

' "' And recordDate >= '" & startDate.ToString("yyyyMMdd") & "' And " & _

' "recordDate <= '" & endDate.ToString("yyyyMMdd") & "' Order By recordDate"

'

' ' The most convenient way to read the SQL result into arrays is to use the

' ' ChartDirector DBTable utility.

' Dim table As DBTable = New DBTable(sqlCmd.ExecuteReader())

' dbconn.Close()

'

' ' Now get the data into arrays

' timeStamps = table.getColAsDateTime(0)

' highData = table.getCol(1)

' lowData = table.getCol(2)

' openData = table.getCol(3)

' closeData = table.getCol(4)

' volData = table.getCol(5)

'

generateRandomData(ticker, startDate, endDate, 86400)

End Sub

'/ <summary>

'/ Get weekly data series for timeStamps, highData, lowData, openData, closeData

'/ and volData.

'/ </summary>

'/ <param name="ticker">The ticker symbol for the data series.</param>

'/ <param name="startDate">The starting date/time for the data series.</param>

'/ <param name="endDate">The ending date/time for the data series.</param>

Protected Sub getWeeklyData(ticker As String, startDate As Date, endDate As Date)

'

' If you do not have weekly data, you may call "getDailyData(startDate, endDate)" to get daily

' data, then call "convertDailyToWeeklyData()" to convert to weekly data.

'

generateRandomData(ticker, startDate, endDate, 86400 * 7)

End Sub

'/ <summary>

'/ Get monthly data series for timeStamps, highData, lowData, openData, closeData

'/ and volData.

'/ </summary>

'/ <param name="ticker">The ticker symbol for the data series.</param>

'/ <param name="startDate">The starting date/time for the data series.</param>

'/ <param name="endDate">The ending date/time for the data series.</param>

Protected Sub getMonthlyData(ticker As String, startDate As Date, endDate As Date)

'

' If you do not have weekly data, you may call "getDailyData(startDate, endDate)" to get daily

' data, then call "convertDailyToMonthlyData()" to convert to monthly data.

'

generateRandomData(ticker, startDate, endDate, 86400 * 30)

End Sub

'/ <summary>

'/ A random number generator designed to generate realistic financial data.

'/ </summary>

'/ <param name="ticker">The ticker symbol for the data series.</param>

'/ <param name="startDate">The starting date/time for the data series.</param>

'/ <param name="endDate">The ending date/time for the data series.</param>

'/ <param name="resolution">The period of the data series.</param>

Protected Sub generateRandomData(ticker As String, startDate As Date, endDate As Date, _

resolution As Integer)

Dim db As FinanceSimulator = New FinanceSimulator(ticker, startDate, endDate, resolution)

timeStamps = db.getTimeStamps()

highData = db.getHighData()

lowData = db.getLowData()

openData = db.getOpenData()

closeData = db.getCloseData()

volData = db.getVolData()

End Sub

'/ <summary>

'/ A utility to convert daily to weekly data.

'/ </summary>

Protected Sub convertDailyToWeeklyData()

aggregateData(New ArrayMath(timeStamps).selectStartOfWeek())

End Sub

'/ <summary>

'/ A utility to convert daily to monthly data.

'/ </summary>

Protected Sub convertDailyToMonthlyData()

aggregateData(New ArrayMath(timeStamps).selectStartOfMonth())

End Sub

'/ <summary>

'/ An internal method used to aggregate daily data.

'/ </summary>

Protected Sub aggregateData(aggregator As ArrayMath)

timeStamps = Chart.NTime(aggregator.aggregate(Chart.CTime(timeStamps), Chart.AggregateFirst))

highData = aggregator.aggregate(highData, Chart.AggregateMax)

lowData = aggregator.aggregate(lowData, Chart.AggregateMin)

openData = aggregator.aggregate(openData, Chart.AggregateFirst)

closeData = aggregator.aggregate(closeData, Chart.AggregateLast)

volData = aggregator.aggregate(volData, Chart.AggregateSum)

End Sub

'/ <summary>

'/ Create a financial chart according to user selections. The user selections are

'/ encoded in the query parameters.

'/ </summary>

Public Function drawChart() As BaseChart

' In this demo, we just assume we plot up to the latest time. So end date is now.

Dim endDate As Date = Now

' If the trading day has not yet started (before 9:30am), or if the end date is on on Sat or

' Sun, we set the end date to 4:00pm of the last trading day

Do While (endDate.TimeOfDay.CompareTo(New TimeSpan(9, 30, 0)) < 0) OrElse (endDate.DayOfWeek = _

DayOfWeek.Sunday) OrElse (endDate.DayOfWeek = DayOfWeek.Saturday)

endDate = endDate.Date.AddDays(-1).Add(New TimeSpan(16, 0, 0))

Loop

' The duration selected by the user

Dim durationInDays As Integer = CInt(TimeRange.SelectedItem.Value)

' Compute the start date by subtracting the duration from the end date.

Dim startDate As Date = endDate

If durationInDays >= 30 Then

' More or equal to 30 days - so we use months as the unit

startDate = New DateTime(endDate.Year, endDate.Month, 1).AddMonths(-durationInDays / 30)

Else

' Less than 30 days - use day as the unit. The starting point of the axis is always at the

' start of the day (9:30am). Note that we use trading days, so we skip Sat and Sun in

' counting the days.

startDate = endDate.Date

For i As Integer = 1 To durationInDays - 1

If startDate.DayOfWeek = DayOfWeek.Monday Then

startDate = startDate.AddDays(-3)

Else

startDate = startDate.AddDays(-1)

End If

Next

End If

' The moving average periods selected by the user.

Dim avgPeriod1 As Integer = 0

If isNumeric(movAvg1.Text) Then

avgPeriod1 = CInt(movAvg1.Text)

Else

avgPeriod1 = 0

End If

Dim avgPeriod2 As Integer = 0

If isNumeric(movAvg2.Text) Then

avgPeriod2 = CInt(movAvg2.Text)

Else

avgPeriod2 = 0

End If

If avgPeriod1 < 0 Then

avgPeriod1 = 0

ElseIf avgPeriod1 > 300 Then

avgPeriod1 = 300

End If

If avgPeriod2 < 0 Then

avgPeriod2 = 0

ElseIf avgPeriod2 > 300 Then

avgPeriod2 = 300

End If

' We need extra leading data points in order to compute moving averages.

Dim extraPoints As Integer = 20

If avgPeriod1 > extraPoints Then

extraPoints = avgPeriod1

End If

If avgPeriod2 > extraPoints Then

extraPoints = avgPeriod2

End If

' Get the data series to compare with, if any.

Dim compareKey As String = Trim(CompareWith.Text)

compareData = Nothing

If getData(compareKey, startDate, endDate, durationInDays, extraPoints) Then

compareData = closeData

End If

' The data series we want to get.

Dim tickerKey As String = Trim(TickerSymbol.Text)

If Not getData(tickerKey, startDate, endDate, durationInDays, extraPoints) Then

Return errMsg("Please enter a valid ticker symbol")

End If

' We now confirm the actual number of extra points (data points that are before the start date)

' as inferred using actual data from the database.

extraPoints = UBound(timeStamps) + 1

For i As Integer = 0 To UBound(timeStamps)

If timeStamps(i) >= startDate Then

extraPoints = i

Exit For

End If

Next

' Check if there is any valid data

If extraPoints >= UBound(timeStamps) + 1 Then

' No data - just display the no data message.

Return errMsg("No data available for the specified time period")

End If

' In some finance chart presentation style, even if the data for the latest day is not fully

' available, the axis for the entire day will still be drawn, where no data will appear near the

' end of the axis.

If resolution < 86400 Then

' Add extra points to the axis until it reaches the end of the day. The end of day is

' assumed to be 16:00 (it depends on the stock exchange).

Dim lastTime As Date = timeStamps(UBound(timeStamps))

Dim extraTrailingPoints As Integer = Int(New TimeSpan(16, 0, 0).Subtract( _

lastTime.TimeOfDay).TotalSeconds / resolution)

If extraTrailingPoints > 0 Then

Dim extendedTimeStamps(timeStamps.Length + extraTrailingPoints - 1) As Date

Array.Copy(timeStamps, 0, extendedTimeStamps, 0, timeStamps.Length)

For i As Integer = 0 To extraTrailingPoints - 1

extendedTimeStamps(i + timeStamps.Length) = lastTime.AddSeconds(resolution * (i + _

1))

Next

timeStamps = extendedTimeStamps

End If

End If

'

' At this stage, all data are available. We can draw the chart as according to user input.

'

'

' Determine the chart size. In this demo, user can select 4 different chart sizes. Default is

' the large chart size.

'

Dim width As Integer = 780

Dim mainHeight As Integer = 255

Dim indicatorHeight As Integer = 80

Dim size As String = ChartSize.SelectedItem.Value

If size = "S" Then

' Small chart size

width = 450

mainHeight = 160

indicatorHeight = 60

ElseIf size = "M" Then

' Medium chart size

width = 620

mainHeight = 215

indicatorHeight = 70

ElseIf size = "H" Then

' Huge chart size

width = 1000

mainHeight = 320

indicatorHeight = 90

End If

' Create the chart object using the selected size

Dim m As FinanceChart = New FinanceChart(width)

' Set the data into the chart object

m.setData(timeStamps, highData, lowData, openData, closeData, volData, extraPoints)

'

' We configure the title of the chart. In this demo chart design, we put the company name as the

' top line of the title with left alignment.

'

m.addPlotAreaTitle(Chart.TopLeft, tickerKey)

' We displays the current date as well as the data resolution on the next line.

Dim resolutionText As String = ""

If resolution = 30 * 86400 Then

resolutionText = "Monthly"

ElseIf resolution = 7 * 86400 Then

resolutionText = "Weekly"

ElseIf resolution = 86400 Then

resolutionText = "Daily"

ElseIf resolution = 900 Then

resolutionText = "15-min"

End If

m.addPlotAreaTitle(Chart.BottomLeft, "<*font=Arial,size=8*>" & m.formatValue(Now, _

"mmm dd, yyyy") & " - " & resolutionText & " chart")

' A copyright message at the bottom left corner the title area

m.addPlotAreaTitle(Chart.BottomRight, "<*font=Arial,size=8*>(c) Advanced Software Engineering")

'

' Add the first techical indicator according. In this demo, we draw the first indicator on top

' of the main chart.

'

addIndicator(m, Indicator1.SelectedItem.Value, indicatorHeight)

'

' Add the main chart

'

m.addMainChart(mainHeight)

'

' Set log or linear scale according to user preference

'

If LogScale.Checked Then

m.setLogScale(True)

End If

'

' Set axis labels to show data values or percentage change to user preference

'

If PercentageScale.Checked Then

m.setPercentageAxis()

End If

'

' Draw any price line the user has selected

'

Dim mainType As String = ChartType.SelectedItem.Value

If mainType = "Close" Then

m.addCloseLine(&H000040)

ElseIf mainType = "TP" Then

m.addTypicalPrice(&H000040)

ElseIf mainType = "WC" Then

m.addWeightedClose(&H000040)

ElseIf mainType = "Median" Then

m.addMedianPrice(&H000040)

End If

'

' Add comparison line if there is data for comparison

'

If Not (compareData Is Nothing) Then

If UBound(compareData) + 1 > extraPoints Then

m.addComparison(compareData, &H0000ff, compareKey)

End If

End If

'

' Add moving average lines.

'

addMovingAvg(m, avgType1.SelectedItem.Value, avgPeriod1, &H663300)

addMovingAvg(m, avgType2.SelectedItem.Value, avgPeriod2, &H9900ff)

'

' Draw candlesticks or OHLC symbols if the user has selected them.

'

If mainType = "CandleStick" Then

m.addCandleStick(&H33ff33, &Hff3333)

ElseIf mainType = "OHLC" Then

m.addHLOC(&H008800, &Hcc0000)

End If

'

' Add parabolic SAR if necessary

'

If ParabolicSAR.Checked Then

m.addParabolicSAR(0.02, 0.02, 0.2, Chart.DiamondShape, 5, &H008800, &H000000)

End If

'

' Add price band/channel/envelop to the chart according to user selection

'

Dim bandType As String = Band.SelectedItem.Value

If bandType = "BB" Then

m.addBollingerBand(20, 2, &H9999ff, &Hc06666ff)

ElseIf bandType = "DC" Then

m.addDonchianChannel(20, &H9999ff, &Hc06666ff)

ElseIf bandType = "Envelop" Then

m.addEnvelop(20, 0.1, &H9999ff, &Hc06666ff)

End If

'

' Add volume bars to the main chart if necessary

'

If Volume.Checked Then

m.addVolBars(indicatorHeight, &H99ff99, &Hff9999, &Hc0c0c0)

End If

'

' Add additional indicators as according to user selection.

'

addIndicator(m, Indicator2.SelectedItem.Value, indicatorHeight)

addIndicator(m, Indicator3.SelectedItem.Value, indicatorHeight)

addIndicator(m, Indicator4.SelectedItem.Value, indicatorHeight)

Return m

End Function

'/ <summary>

'/ Add a moving average line to the FinanceChart object.

'/ </summary>

'/ <param name="m">The FinanceChart object to add the line to.</param>

'/ <param name="avgType">The moving average type (SMA/EMA/TMA/WMA).</param>

'/ <param name="avgPeriod">The moving average period.</param>

'/ <param name="color">The color of the line.</param>

'/ <returns>The LineLayer object representing line layer created.</returns>

Protected Function addMovingAvg(m As FinanceChart, avgType As String, avgPeriod As Integer, _

color As Integer) As LineLayer

If avgPeriod > 1 Then

If avgType = "SMA" Then

Return m.addSimpleMovingAvg(avgPeriod, color)

ElseIf avgType = "EMA" Then

Return m.addExpMovingAvg(avgPeriod, color)

ElseIf avgType = "TMA" Then

Return m.addTriMovingAvg(avgPeriod, color)

ElseIf avgType = "WMA" Then

Return m.addWeightedMovingAvg(avgPeriod, color)

End If

End If

Return Nothing

End Function

'/ <summary>

'/ Add an indicator chart to the FinanceChart object. In this demo example, the

'/ indicator parameters (such as the period used to compute RSI, colors of the lines,

'/ etc.) are hard coded to commonly used values. You are welcome to design a more

'/ complex user interface to allow users to set the parameters.

'/ </summary>

'/ <param name="m">The FinanceChart object to add the line to.</param>

'/ <param name="indicator">The selected indicator.</param>

'/ <param name="height">Height of the chart in pixels</param>

'/ <returns>The XYChart object representing indicator chart.</returns>

Protected Function addIndicator(m As FinanceChart, indicator As String, height As Integer) As _

XYChart

If indicator = "RSI" Then

Return m.addRSI(height, 14, &H800080, 20, &Hff6666, &H6666ff)

ElseIf indicator = "StochRSI" Then

Return m.addStochRSI(height, 14, &H800080, 30, &Hff6666, &H6666ff)

ElseIf indicator = "MACD" Then

Return m.addMACD(height, 26, 12, 9, &H0000ff, &Hff00ff, &H008000)

ElseIf indicator = "FStoch" Then

Return m.addFastStochastic(height, 14, 3, &H006060, &H606000)

ElseIf indicator = "SStoch" Then

Return m.addSlowStochastic(height, 14, 3, &H006060, &H606000)

ElseIf indicator = "ATR" Then

Return m.addATR(height, 14, &H808080, &H0000ff)

ElseIf indicator = "ADX" Then

Return m.addADX(height, 14, &H008000, &H800000, &H000080)

ElseIf indicator = "DCW" Then

Return m.addDonchianWidth(height, 20, &H0000ff)

ElseIf indicator = "BBW" Then

Return m.addBollingerWidth(height, 20, 2, &H0000ff)

ElseIf indicator = "DPO" Then

Return m.addDPO(height, 20, &H0000ff)

ElseIf indicator = "PVT" Then

Return m.addPVT(height, &H0000ff)

ElseIf indicator = "Momentum" Then

Return m.addMomentum(height, 12, &H0000ff)

ElseIf indicator = "Performance" Then

Return m.addPerformance(height, &H0000ff)

ElseIf indicator = "ROC" Then

Return m.addROC(height, 12, &H0000ff)

ElseIf indicator = "OBV" Then

Return m.addOBV(height, &H0000ff)

ElseIf indicator = "AccDist" Then

Return m.addAccDist(height, &H0000ff)

ElseIf indicator = "CLV" Then

Return m.addCLV(height, &H0000ff)

ElseIf indicator = "WilliamR" Then

Return m.addWilliamR(height, 14, &H800080, 30, &Hff6666, &H6666ff)

ElseIf indicator = "Aroon" Then

Return m.addAroon(height, 14, &H339933, &H333399)

ElseIf indicator = "AroonOsc" Then

Return m.addAroonOsc(height, 14, &H0000ff)

ElseIf indicator = "CCI" Then

Return m.addCCI(height, 20, &H800080, 100, &Hff6666, &H6666ff)

ElseIf indicator = "EMV" Then

Return m.addEaseOfMovement(height, 9, &H006060, &H606000)

ElseIf indicator = "MDX" Then

Return m.addMassIndex(height, &H800080, &Hff6666, &H6666ff)

ElseIf indicator = "CVolatility" Then

Return m.addChaikinVolatility(height, 10, 10, &H0000ff)

ElseIf indicator = "COscillator" Then

Return m.addChaikinOscillator(height, &H0000ff)

ElseIf indicator = "CMF" Then

Return m.addChaikinMoneyFlow(height, 21, &H008000)

ElseIf indicator = "NVI" Then

Return m.addNVI(height, 255, &H0000ff, &H883333)

ElseIf indicator = "PVI" Then

Return m.addPVI(height, 255, &H0000ff, &H883333)

ElseIf indicator = "MFI" Then

Return m.addMFI(height, 14, &H800080, 30, &Hff6666, &H6666ff)

ElseIf indicator = "PVO" Then

Return m.addPVO(height, 26, 12, 9, &H0000ff, &Hff00ff, &H008000)

ElseIf indicator = "PPO" Then

Return m.addPPO(height, 26, 12, 9, &H0000ff, &Hff00ff, &H008000)

ElseIf indicator = "UO" Then

Return m.addUltimateOscillator(height, 7, 14, 28, &H800080, 20, &Hff6666, &H6666ff)

ElseIf indicator = "Vol" Then

Return m.addVolIndicator(height, &H99ff99, &Hff9999, &Hc0c0c0)

ElseIf indicator = "TRIX" Then

Return m.addTRIX(height, 12, &H0000ff)

End If

Return Nothing

End Function

'/ <summary>

'/ Creates a dummy chart to show an error message.

'/ </summary>

'/ <param name="msg">The error message.

'/ <returns>The BaseChart object containing the error message.</returns>

Protected Function errMsg(msg As String) As BaseChart

Dim m As MultiChart = New MultiChart(400, 200)

m.addTitle2(Chart.Center, msg, "Arial", 10).setMaxWidth(m.getWidth())

Return m

End Function

'

' Page Load event handler

'

Private Sub Page_Load(sender As System.Object, e As System.EventArgs)

' Create the finance chart

Dim c As BaseChart = drawChart()

' Output the chart

WebChartViewer1.Image = c.makeWebImage(Chart.SVG)

End Sub

</script>

<!DOCTYPE html>

<html>

<head>

<title>ChartDirector Financial Chart Demonstration</title>

<style>

.inputtitle {font:11px verdana; margin:10px 5px;}

.input {font:11px verdana}

</style>

</head>

<body style="margin:0px">

<table style="border:0px; padding:0px; border-spacing:0px;">

<tr>

<td align="right" colspan="2" style="background:#000088">

<div style="padding:0px 3px 2px 0px; font:bold italic 10pt arial;">

<a style="color:#ffff00; text-decoration:none" href="http://www.advsofteng.com">

Advanced Software Engineering

</a>

</div>

</td>

</tr>

<tr valign="top">

<td style="width:150px; background:#bbddff">

<form id="Form1" method="post" runat="server">

<div class="inputtitle">

<b>Ticker Symbol</b><br />

<asp:TextBox runat="server" id="TickerSymbol" class="input" style="width:140px;">ASE.SYMBOL</asp:TextBox>

</div>

<div class="inputtitle">

<b>Compare With</b><br />

<asp:TextBox runat="server" id="CompareWith" class="input" style="width:140px;"></asp:TextBox>

</div>

<div class="inputtitle">

<b>Time Period</b><br />

<asp:DropDownList runat="server" id="TimeRange" class="input" style="width:140px;">

<asp:ListItem value="1">1 day</asp:ListItem>

<asp:ListItem value="2">2 days</asp:ListItem>

<asp:ListItem value="5">5 days</asp:ListItem>

<asp:ListItem value="10">10 days</asp:ListItem>

<asp:ListItem value="30">1 month</asp:ListItem>

<asp:ListItem value="60">2 months</asp:ListItem>

<asp:ListItem value="90">3 months</asp:ListItem>

<asp:ListItem value="180" Selected="True">6 months</asp:ListItem>

<asp:ListItem value="360">1 year</asp:ListItem>

<asp:ListItem value="720">2 years</asp:ListItem>

<asp:ListItem value="1080">3 years</asp:ListItem>

<asp:ListItem value="1440">4 years</asp:ListItem>

<asp:ListItem value="1800">5 years</asp:ListItem>

<asp:ListItem value="3600">10 years</asp:ListItem>

</asp:DropDownList>

</div>

<div class="inputtitle">

<b>Chart Size</b><br />

<asp:DropDownList runat="server" id="ChartSize" class="input" style="width:140px;">

<asp:ListItem value="S">Small</asp:ListItem>

<asp:ListItem value="M">Medium</asp:ListItem>

<asp:ListItem value="L" Selected="True">Large</asp:ListItem>

<asp:ListItem value="H">Huge</asp:ListItem>

</asp:DropDownList><br />

</div>

<div class="inputtitle">

<asp:CheckBox runat="server" Text="Show Volume Bars" id="Volume" Checked="True"></asp:CheckBox><br />

<asp:CheckBox runat="server" Text="Parabolic SAR" id="ParabolicSAR"></asp:CheckBox><br />

<asp:CheckBox runat="server" Text="Log Scale" id="LogScale"></asp:CheckBox><br />

<asp:CheckBox runat="server" Text="Percentage Scale" id="PercentageScale"></asp:CheckBox><br />

</div>

<div class="inputtitle">

<b>Chart Type</b><br />

<asp:DropDownList runat="server" id="ChartType" class="input" style="width:140px;">

<asp:ListItem value="None">None</asp:ListItem>

<asp:ListItem value="CandleStick" Selected="True">CandleStick</asp:ListItem>

<asp:ListItem value="Close">Closing Price</asp:ListItem>

<asp:ListItem value="Median">Median Price</asp:ListItem>

<asp:ListItem value="OHLC">OHLC</asp:ListItem>

<asp:ListItem value="TP">Typical Price</asp:ListItem>

<asp:ListItem value="WC">Weighted Close</asp:ListItem>

</asp:DropDownList>

</div>

<div class="inputtitle">

<b>Price Band</b><br />

<asp:DropDownList runat="server" id="Band" class="input" style="width:140px;">

<asp:ListItem value="None">None</asp:ListItem>

<asp:ListItem value="BB" Selected="True">Bollinger Band</asp:ListItem>

<asp:ListItem value="DC">Donchian Channel</asp:ListItem>

<asp:ListItem value="Envelop">Envelop (SMA 20 +/- 10%)</asp:ListItem>

</asp:DropDownList>

</div>

<div class="inputtitle">

<b>Moving Averages</b><br />

<asp:DropDownList runat="server" id="avgType1" class="input" style="width:105px;">

<asp:ListItem value="None">None</asp:ListItem>

<asp:ListItem value="SMA" Selected="True">Simple</asp:ListItem>

<asp:ListItem value="EMA">Exponential</asp:ListItem>

<asp:ListItem value="TMA">Triangular</asp:ListItem>

<asp:ListItem value="WMA">Weighted</asp:ListItem>

</asp:DropDownList>

<asp:TextBox runat="server" id="movAvg1" class="input" style="width:30px;">10</asp:TextBox><br />

<asp:DropDownList runat="server" id="avgType2" class="input" style="width:105px;">

<asp:ListItem value="None">None</asp:ListItem>

<asp:ListItem value="SMA" Selected="True">Simple</asp:ListItem>

<asp:ListItem value="EMA">Exponential</asp:ListItem>

<asp:ListItem value="TMA">Triangular</asp:ListItem>

<asp:ListItem value="WMA">Weighted</asp:ListItem>

</asp:DropDownList>

<asp:TextBox runat="server" id="movAvg2" class="input" style="width:30px;">25</asp:TextBox><br />

</div>

<div class="inputtitle">

<b>Technical Indicators</b><br />

<asp:DropDownList runat="server" id="Indicator1" class="input" style="width:140px;">

<asp:ListItem value="None">None</asp:ListItem>

<asp:ListItem value="AccDist">Accumulation/Distribution</asp:ListItem>

<asp:ListItem value="AroonOsc">Aroon Oscillator</asp:ListItem>

<asp:ListItem value="Aroon">Aroon Up/Down</asp:ListItem>

<asp:ListItem value="ADX">Avg Directional Index</asp:ListItem>

<asp:ListItem value="ATR">Avg True Range</asp:ListItem>

<asp:ListItem value="BBW">Bollinger Band Width</asp:ListItem>

<asp:ListItem value="CMF">Chaikin Money Flow</asp:ListItem>

<asp:ListItem value="COscillator">Chaikin Oscillator</asp:ListItem>

<asp:ListItem value="CVolatility">Chaikin Volatility</asp:ListItem>

<asp:ListItem value="CLV">Close Location Value</asp:ListItem>

<asp:ListItem value="CCI">Commodity Channel Index</asp:ListItem>

<asp:ListItem value="DPO">Detrended Price Osc</asp:ListItem>

<asp:ListItem value="DCW">Donchian Channel Width</asp:ListItem>

<asp:ListItem value="EMV">Ease of Movement</asp:ListItem>

<asp:ListItem value="FStoch">Fast Stochastic</asp:ListItem>

<asp:ListItem value="MACD">MACD</asp:ListItem>

<asp:ListItem value="MDX">Mass Index</asp:ListItem>

<asp:ListItem value="Momentum">Momentum</asp:ListItem>

<asp:ListItem value="MFI">Money Flow Index</asp:ListItem>

<asp:ListItem value="NVI">Neg Volume Index</asp:ListItem>

<asp:ListItem value="OBV">On Balance Volume</asp:ListItem>

<asp:ListItem value="Performance">Performance</asp:ListItem>

<asp:ListItem value="PPO">% Price Oscillator</asp:ListItem>

<asp:ListItem value="PVO">% Volume Oscillator</asp:ListItem>

<asp:ListItem value="PVI">Pos Volume Index</asp:ListItem>

<asp:ListItem value="PVT">Price Volume Trend</asp:ListItem>

<asp:ListItem value="ROC">Rate of Change</asp:ListItem>

<asp:ListItem value="RSI" Selected="True">RSI</asp:ListItem>

<asp:ListItem value="SStoch">Slow Stochastic</asp:ListItem>

<asp:ListItem value="StochRSI">StochRSI</asp:ListItem>

<asp:ListItem value="TRIX">TRIX</asp:ListItem>

<asp:ListItem value="UO">Ultimate Oscillator</asp:ListItem>

<asp:ListItem value="Vol">Volume</asp:ListItem>

<asp:ListItem value="WilliamR">William's %R</asp:ListItem>

</asp:DropDownList><br />

<asp:DropDownList runat="server" id="Indicator2" class="input" style="width:140px;">

<asp:ListItem value="None">None</asp:ListItem>

<asp:ListItem value="AccDist">Accumulation/Distribution</asp:ListItem>

<asp:ListItem value="AroonOsc">Aroon Oscillator</asp:ListItem>

<asp:ListItem value="Aroon">Aroon Up/Down</asp:ListItem>

<asp:ListItem value="ADX">Avg Directional Index</asp:ListItem>

<asp:ListItem value="ATR">Avg True Range</asp:ListItem>

<asp:ListItem value="BBW">Bollinger Band Width</asp:ListItem>

<asp:ListItem value="CMF">Chaikin Money Flow</asp:ListItem>

<asp:ListItem value="COscillator">Chaikin Oscillator</asp:ListItem>

<asp:ListItem value="CVolatility">Chaikin Volatility</asp:ListItem>

<asp:ListItem value="CLV">Close Location Value</asp:ListItem>

<asp:ListItem value="CCI">Commodity Channel Index</asp:ListItem>

<asp:ListItem value="DPO">Detrended Price Osc</asp:ListItem>

<asp:ListItem value="DCW">Donchian Channel Width</asp:ListItem>

<asp:ListItem value="EMV">Ease of Movement</asp:ListItem>

<asp:ListItem value="FStoch">Fast Stochastic</asp:ListItem>

<asp:ListItem value="MACD" Selected="True">MACD</asp:ListItem>

<asp:ListItem value="MDX">Mass Index</asp:ListItem>

<asp:ListItem value="Momentum">Momentum</asp:ListItem>

<asp:ListItem value="MFI">Money Flow Index</asp:ListItem>

<asp:ListItem value="NVI">Neg Volume Index</asp:ListItem>

<asp:ListItem value="OBV">On Balance Volume</asp:ListItem>

<asp:ListItem value="Performance">Performance</asp:ListItem>

<asp:ListItem value="PPO">% Price Oscillator</asp:ListItem>

<asp:ListItem value="PVO">% Volume Oscillator</asp:ListItem>

<asp:ListItem value="PVI">Pos Volume Index</asp:ListItem>

<asp:ListItem value="PVT">Price Volume Trend</asp:ListItem>

<asp:ListItem value="ROC">Rate of Change</asp:ListItem>

<asp:ListItem value="RSI">RSI</asp:ListItem>

<asp:ListItem value="SStoch">Slow Stochastic</asp:ListItem>

<asp:ListItem value="StochRSI">StochRSI</asp:ListItem>

<asp:ListItem value="TRIX">TRIX</asp:ListItem>

<asp:ListItem value="UO">Ultimate Oscillator</asp:ListItem>

<asp:ListItem value="Vol">Volume</asp:ListItem>

<asp:ListItem value="WilliamR">William's %R</asp:ListItem>

</asp:DropDownList><br />

<asp:DropDownList runat="server" id="Indicator3" class="input" style="width:140px;">

<asp:ListItem value="None" Selected="True">None</asp:ListItem>

<asp:ListItem value="AccDist">Accumulation/Distribution</asp:ListItem>

<asp:ListItem value="AroonOsc">Aroon Oscillator</asp:ListItem>

<asp:ListItem value="Aroon">Aroon Up/Down</asp:ListItem>

<asp:ListItem value="ADX">Avg Directional Index</asp:ListItem>

<asp:ListItem value="ATR">Avg True Range</asp:ListItem>

<asp:ListItem value="BBW">Bollinger Band Width</asp:ListItem>

<asp:ListItem value="CMF">Chaikin Money Flow</asp:ListItem>

<asp:ListItem value="COscillator">Chaikin Oscillator</asp:ListItem>

<asp:ListItem value="CVolatility">Chaikin Volatility</asp:ListItem>

<asp:ListItem value="CLV">Close Location Value</asp:ListItem>

<asp:ListItem value="CCI">Commodity Channel Index</asp:ListItem>

<asp:ListItem value="DPO">Detrended Price Osc</asp:ListItem>

<asp:ListItem value="DCW">Donchian Channel Width</asp:ListItem>

<asp:ListItem value="EMV">Ease of Movement</asp:ListItem>

<asp:ListItem value="FStoch">Fast Stochastic</asp:ListItem>

<asp:ListItem value="MACD">MACD</asp:ListItem>

<asp:ListItem value="MDX">Mass Index</asp:ListItem>

<asp:ListItem value="Momentum">Momentum</asp:ListItem>

<asp:ListItem value="MFI">Money Flow Index</asp:ListItem>

<asp:ListItem value="NVI">Neg Volume Index</asp:ListItem>

<asp:ListItem value="OBV">On Balance Volume</asp:ListItem>

<asp:ListItem value="Performance">Performance</asp:ListItem>

<asp:ListItem value="PPO">% Price Oscillator</asp:ListItem>

<asp:ListItem value="PVO">% Volume Oscillator</asp:ListItem>

<asp:ListItem value="PVI">Pos Volume Index</asp:ListItem>

<asp:ListItem value="PVT">Price Volume Trend</asp:ListItem>

<asp:ListItem value="ROC">Rate of Change</asp:ListItem>

<asp:ListItem value="RSI">RSI</asp:ListItem>

<asp:ListItem value="SStoch">Slow Stochastic</asp:ListItem>

<asp:ListItem value="StochRSI">StochRSI</asp:ListItem>

<asp:ListItem value="TRIX">TRIX</asp:ListItem>

<asp:ListItem value="UO">Ultimate Oscillator</asp:ListItem>

<asp:ListItem value="Vol">Volume</asp:ListItem>

<asp:ListItem value="WilliamR">William's %R</asp:ListItem>

</asp:DropDownList><br />

<asp:DropDownList runat="server" id="Indicator4" class="input" style="width:140px;">

<asp:ListItem value="None" Selected="True">None</asp:ListItem>

<asp:ListItem value="AccDist">Accumulation/Distribution</asp:ListItem>

<asp:ListItem value="AroonOsc">Aroon Oscillator</asp:ListItem>