require("financechart")

class FinancesymbolsController < ApplicationController

def index()

@title = "Finance Chart Custom Symbols"

@ctrl_file = File.expand_path(__FILE__)

@noOfCharts = 1

render :template => "templates/chartview"

end

#

# Render and deliver the chart

#

def getchart()

# This script can draw different charts depending on the chartIndex

chartIndex = (params["img"]).to_i

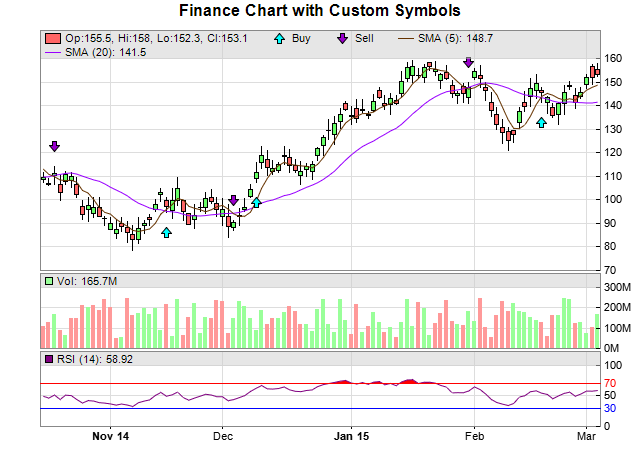

# Create a finance chart demo containing 100 days of data

noOfDays = 100

# To compute moving averages starting from the first day, we need to get extra data points

# before the first day

extraDays = 30

# In this exammple, we use a random number generator utility to simulate the data. We set up

# the random table to create 6 cols x (noOfDays + extraDays) rows, using 9 as the seed.

rantable = ChartDirector::RanTable.new(9, 6, noOfDays + extraDays)

# Set the 1st col to be the timeStamp, starting from Sep 4, 2014, with each row representing

# one day, and counting week days only (jump over Sat and Sun)

rantable.setDateCol(0, Time.mktime(2014, 9, 4), 86400, true)

# Set the 2nd, 3rd, 4th and 5th columns to be high, low, open and close data. The open value

# starts from 100, and the daily change is random from -5 to 5.

rantable.setHLOCCols(1, 100, -5, 5)

# Set the 6th column as the vol data from 5 to 25 million

rantable.setCol(5, 50000000, 250000000)

# Now we read the data from the table into arrays

timeStamps = rantable.getCol(0)

highData = rantable.getCol(1)

lowData = rantable.getCol(2)

openData = rantable.getCol(3)

closeData = rantable.getCol(4)

volData = rantable.getCol(5)

# Custom data series should be of the same length as the OHLC data series

buySignal = Array.new(closeData.length, 0)

sellSignal = Array.new(closeData.length, 0)

#

# The following is just an arbitrary algorithm to create some meaningless buySignal and

# sellSignal. They are just for demonstrating the charting engine. Please do not use them

# for actual trading.

#

sma5 = ChartDirector::ArrayMath.new(closeData).movAvg(5).result()

sma20 = ChartDirector::ArrayMath.new(closeData).movAvg(20).result()

0.upto(sma5.length - 1) do |i|

buySignal[i] = ChartDirector::NoValue

sellSignal[i] = ChartDirector::NoValue

if i > 0

if (sma5[i - 1] <= sma20[i - 1]) && (sma5[i] > sma20[i])

buySignal[i] = lowData[i]

end

if (sma5[i - 1] >= sma20[i - 1]) && (sma5[i] < sma20[i])

sellSignal[i] = highData[i]

end

end

end

# Create a FinanceChart object of width 640 pixels

c = ChartDirector::FinanceChart.new(640)

# Add a title to the chart

c.addTitle("Finance Chart with Custom Symbols")

# Set the data into the finance chart object

c.setData(timeStamps, highData, lowData, openData, closeData, volData, extraDays)

# Add the main chart with 240 pixels in height

mainChart = c.addMainChart(240)

# Add buy signal symbols to the main chart, using cyan (0x00ffff) upward pointing arrows as

# symbols

buyLayer = mainChart.addScatterLayer(nil, buySignal, "Buy", ChartDirector::ArrowShape(0, 1,

0.4, 0.4), 11, 0x00ffff)

# Shift the symbol lower by 20 pixels

buyLayer.getDataSet(0).setSymbolOffset(0, 20)

# Add sell signal symbols to the main chart, using purple (0x9900cc) downward pointing

# arrows as symbols

sellLayer = mainChart.addScatterLayer(nil, sellSignal, "Sell", ChartDirector::ArrowShape(

180, 1, 0.4, 0.4), 11, 0x9900cc)

# Shift the symbol higher by 20 pixels

sellLayer.getDataSet(0).setSymbolOffset(0, -20)

# Add a 5 period simple moving average to the main chart, using brown color

c.addSimpleMovingAvg(5, 0x663300)

# Add a 20 period simple moving average to the main chart, using purple color

c.addSimpleMovingAvg(20, 0x9900ff)

# Add candlestick symbols to the main chart, using green/red for up/down days

c.addCandleStick(0x66ff66, 0xff6666)

# Add a volume indicator chart (75 pixels high) after the main chart, using green/red/grey

# for up/down/flat days

c.addVolIndicator(75, 0x99ff99, 0xff9999, 0x808080)

# Append a 14-days RSI indicator chart (75 pixels high) after the main chart. The main RSI

# line is purple (800080). Set threshold region to +/- 20 (that is, RSI = 50 +/- 25). The

# upper/lower threshold regions will be filled with red (ff0000)/blue (0000ff).

c.addRSI(75, 14, 0x800080, 20, 0xff0000, 0x0000ff)

# Output the chart

send_data(c.makeChart2(ChartDirector::PNG), :type => "image/png", :disposition => "inline")

end

end |