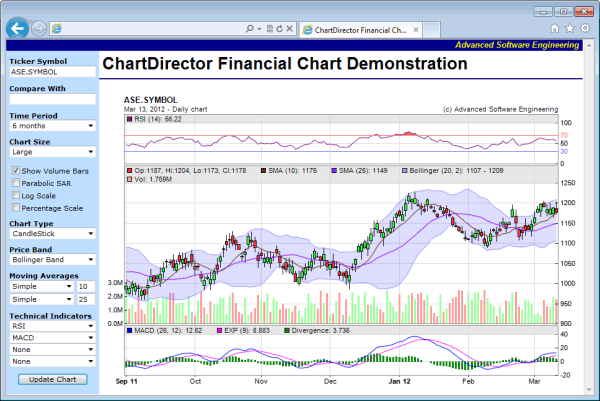

The Interactive Financial Chart is implemented in two parts - "financedemo.jsp" for the containing web page, and "financedemochart.jsp" for the charting page.

The containing web page "financedemo.jsp" is basically just a standard HTML Form. When the "Update Chart" button is pressed, instead of posting to the server, a client side Javascript function is activated. This function combines all Form elements into a query string, appends it to the charting URL "financedemochart.jsp" and uses it to update the <IMG> tag.

The "financedemochart.jsp" draws the finance chart according to the query parameters, which reflects user selections, and outputs the chart to the <IMG> tag.

The "financedemochart.jsp" contains two key parts.

- The get15MinData, getDailyData, getWeeklyData and getMonthlyData functions are for retrieving stock data. In this example, they just retrieve data from a random number generator. You may replace the code in these functions with your own code to get data from your data source.

- The drawChart function is the real charting code. It creates a FinanceChart object, sets data to it, and configures it according to query parameters.

[JSP Version] jspdemo/financedemo.jsp

<!DOCTYPE html>

<html>

<head>

<title>ChartDirector Financial Chart Demonstration</title>

<style>

.inputtitle {font:11px verdana; margin:10px 5px;}

.input {font:11px verdana}

</style>

<script language="Javascript">

//Update the chart according to user selection

function updateChart()

{

//

//we encode the values of all form elements as query parameters

//

var elements = document.getElementById("Form1").elements;

var url = "financedemochart.jsp";

url += (url.indexOf('?') < 0) ? '?' : '&';

for (var i = 0; i < elements.length; ++i)

{

var e = elements[i];

if (e.type == "checkbox")

url = url + e.id + "=" + (e.checked ? "1" : "0") + "&";

else

url = url + e.id + "=" + escape(e.value) + "&";

}

//Now we update the URL of the image to update the chart

document.getElementById("ChartImage").src = url;

}

</script>

</head>

<body style="margin:0px" onLoad="updateChart();">

<table style="border:0px; padding:0px; border-spacing:0px;">

<tr>

<td align="right" colspan="2" style="background:#000088">

<div style="padding:0px 3px 2px 0px; font:bold italic 10pt arial;">

<a style="color:#ffff00; text-decoration:none" href="http://www.advsofteng.com">

Advanced Software Engineering

</a>

</div>

</td>

</tr>

<tr valign="top">

<td style="width:150px; background:#bbddff">

<form id="Form1" action="javascript:updateChart()">

<div class="inputtitle">

<b>Ticker Symbol</b><br />

<input id="TickerSymbol" name="TickerSymbol" class="input" style="width:140px;" value="ASE.SYMBOL">

</div>

<div class="inputtitle">

<b>Compare With</b><br />

<input id="CompareWith" name="CompareWith" class="input" style="width:140px;" value="">

</div>

<div class="inputtitle">

<b>Time Period</b><br />

<select id="TimeRange" name="TimeRange" class="input" style="width:140px;">

<option value="1">1 day</option>

<option value="2">2 days</option>

<option value="5">5 days</option>

<option value="10">10 days</option>

<option value="30">1 month</option>

<option value="60">2 months</option>

<option value="90">3 months</option>

<option value="180" selected>6 months</option>

<option value="360">1 year</option>

<option value="720">2 years</option>

<option value="1080">3 years</option>

<option value="1440">4 years</option>

<option value="1800">5 years</option>

<option value="3600">10 years</option>

</select>

</div>

<div class="inputtitle">

<b>Chart Size</b><br />

<select id="ChartSize" name="ChartSize" class="input" style="width:140px;">

<option value="S">Small</option>

<option value="M">Medium</option>

<option value="L" selected>Large</option>

<option value="H">Huge</option>

</select><br />

</div>

<div class="inputtitle">

<input type="checkbox" id="Volume" name="Volume" checked><label for="Volume">Show Volume Bars</label><br />

<input type="checkbox" id="ParabolicSAR" name="ParabolicSAR"><label for="ParabolicSAR">Parabolic SAR</label><br />

<input type="checkbox" id="LogScale" name="LogScale"><label for="LogScale">Log Scale</label><br />

<input type="checkbox" id="PercentageScale" name="PercentageScale"><label for="PercentageScale">Percentage Scale</label><br />

</div>

<div class="inputtitle">

<b>Chart Type</b><br />

<select id="ChartType" name="ChartType" class="input" style="width:140px;">

<option value="None">None</option>

<option value="CandleStick" selected>CandleStick</option>

<option value="Close">Closing Price</option>

<option value="Median">Median Price</option>

<option value="OHLC">OHLC</option>

<option value="TP">Typical Price</option>

<option value="WC">Weighted Close</option>

</select>

</div>

<div class="inputtitle">

<b>Price Band</b><br />

<select id="Band" name="Band" class="input" style="width:140px;">

<option value="None">None</option>

<option value="BB" selected>Bollinger Band</option>

<option value="DC">Donchian Channel</option>

<option value="Envelop">Envelop (SMA 20 +/- 10%)</option>

</select>

</div>

<div class="inputtitle">

<b>Moving Averages</b><br />

<nobr><select id="avgType1" name="avgType1" class="input" style="width:105px;">

<option value="None">None</option>

<option value="SMA" selected>Simple</option>

<option value="EMA">Exponential</option>

<option value="TMA">Triangular</option>

<option value="WMA">Weighted</option>

</select>

<input id="movAvg1" name="movAvg1" class="input" style="width:30px;" value="10"></nobr><br />

<nobr><select id="avgType2" name="avgType2" class="input" style="width:105px;">

<option value="None">None</option>

<option value="SMA" selected>Simple</option>

<option value="EMA">Exponential</option>

<option value="TMA">Triangular</option>

<option value="WMA">Weighted</option>

</select>

<input id="movAvg2" name="movAvg2" class="input" style="width:30px;" value="25"></nobr><br />

</div>

<div class="inputtitle">

<b>Technical Indicators</b><br />

<select id="Indicator1" name="Indicator1" class="input" style="width:140px;">

<option value="None">None</option>

<option value="AccDist">Accumulation/Distribution</option>

<option value="AroonOsc">Aroon Oscillator</option>

<option value="Aroon">Aroon Up/Down</option>

<option value="ADX">Avg Directional Index</option>

<option value="ATR">Avg True Range</option>

<option value="BBW">Bollinger Band Width</option>

<option value="CMF">Chaikin Money Flow</option>

<option value="COscillator">Chaikin Oscillator</option>

<option value="CVolatility">Chaikin Volatility</option>

<option value="CLV">Close Location Value</option>

<option value="CCI">Commodity Channel Index</option>

<option value="DPO">Detrended Price Osc</option>

<option value="DCW">Donchian Channel Width</option>

<option value="EMV">Ease of Movement</option>

<option value="FStoch">Fast Stochastic</option>

<option value="MACD">MACD</option>

<option value="MDX">Mass Index</option>

<option value="Momentum">Momentum</option>

<option value="MFI">Money Flow Index</option>

<option value="NVI">Neg Volume Index</option>

<option value="OBV">On Balance Volume</option>

<option value="Performance">Performance</option>

<option value="PPO">% Price Oscillator</option>

<option value="PVO">% Volume Oscillator</option>

<option value="PVI">Pos Volume Index</option>

<option value="PVT">Price Volume Trend</option>

<option value="ROC">Rate of Change</option>

<option value="RSI" selected>RSI</option>

<option value="SStoch">Slow Stochastic</option>

<option value="StochRSI">StochRSI</option>

<option value="TRIX">TRIX</option>

<option value="UO">Ultimate Oscillator</option>

<option value="Vol">Volume</option>

<option value="WilliamR">William's %R</option>

</select><br />

<select id="Indicator2" name="Indicator2" class="input" style="width:140px;">

<option value="None">None</option>

<option value="AccDist">Accumulation/Distribution</option>

<option value="AroonOsc">Aroon Oscillator</option>

<option value="Aroon">Aroon Up/Down</option>

<option value="ADX">Avg Directional Index</option>

<option value="ATR">Avg True Range</option>

<option value="BBW">Bollinger Band Width</option>

<option value="CMF">Chaikin Money Flow</option>

<option value="COscillator">Chaikin Oscillator</option>

<option value="CVolatility">Chaikin Volatility</option>

<option value="CLV">Close Location Value</option>

<option value="CCI">Commodity Channel Index</option>

<option value="DPO">Detrended Price Osc</option>

<option value="DCW">Donchian Channel Width</option>

<option value="EMV">Ease of Movement</option>

<option value="FStoch">Fast Stochastic</option>

<option value="MACD" selected>MACD</option>

<option value="MDX">Mass Index</option>

<option value="Momentum">Momentum</option>

<option value="MFI">Money Flow Index</option>

<option value="NVI">Neg Volume Index</option>

<option value="OBV">On Balance Volume</option>

<option value="Performance">Performance</option>

<option value="PPO">% Price Oscillator</option>

<option value="PVO">% Volume Oscillator</option>

<option value="PVI">Pos Volume Index</option>

<option value="PVT">Price Volume Trend</option>

<option value="ROC">Rate of Change</option>

<option value="RSI">RSI</option>

<option value="SStoch">Slow Stochastic</option>

<option value="StochRSI">StochRSI</option>

<option value="TRIX">TRIX</option>

<option value="UO">Ultimate Oscillator</option>

<option value="Vol">Volume</option>

<option value="WilliamR">William's %R</option>

</select><br />

<select id="Indicator3" name="Indicator3" class="input" style="width:140px;">

<option value="None" selected>None</option>

<option value="AccDist">Accumulation/Distribution</option>

<option value="AroonOsc">Aroon Oscillator</option>

<option value="Aroon">Aroon Up/Down</option>

<option value="ADX">Avg Directional Index</option>

<option value="ATR">Avg True Range</option>

<option value="BBW">Bollinger Band Width</option>

<option value="CMF">Chaikin Money Flow</option>

<option value="COscillator">Chaikin Oscillator</option>

<option value="CVolatility">Chaikin Volatility</option>

<option value="CLV">Close Location Value</option>

<option value="CCI">Commodity Channel Index</option>

<option value="DPO">Detrended Price Osc</option>

<option value="DCW">Donchian Channel Width</option>

<option value="EMV">Ease of Movement</option>

<option value="FStoch">Fast Stochastic</option>

<option value="MACD">MACD</option>

<option value="MDX">Mass Index</option>

<option value="Momentum">Momentum</option>

<option value="MFI">Money Flow Index</option>

<option value="NVI">Neg Volume Index</option>

<option value="OBV">On Balance Volume</option>

<option value="Performance">Performance</option>

<option value="PPO">% Price Oscillator</option>

<option value="PVO">% Volume Oscillator</option>

<option value="PVI">Pos Volume Index</option>

<option value="PVT">Price Volume Trend</option>

<option value="ROC">Rate of Change</option>

<option value="RSI">RSI</option>

<option value="SStoch">Slow Stochastic</option>

<option value="StochRSI">StochRSI</option>

<option value="TRIX">TRIX</option>

<option value="UO">Ultimate Oscillator</option>

<option value="Vol">Volume</option>

<option value="WilliamR">William's %R</option>

</select><br />

<select id="Indicator4" name="Indicator4" class="input" style="width:140px;">

<option value="None" selected>None</option>

<option value="AccDist">Accumulation/Distribution</option>

<option value="AroonOsc">Aroon Oscillator</option>

<option value="Aroon">Aroon Up/Down</option>

<option value="ADX">Avg Directional Index</option>

<option value="ATR">Avg True Range</option>

<option value="BBW">Bollinger Band Width</option>

<option value="CMF">Chaikin Money Flow</option>

<option value="COscillator">Chaikin Oscillator</option>

<option value="CVolatility">Chaikin Volatility</option>

<option value="CLV">Close Location Value</option>

<option value="CCI">Commodity Channel Index</option>

<option value="DPO">Detrended Price Osc</option>

<option value="DCW">Donchian Channel Width</option>

<option value="EMV">Ease of Movement</option>

<option value="FStoch">Fast Stochastic</option>

<option value="MACD">MACD</option>

<option value="MDX">Mass Index</option>

<option value="Momentum">Momentum</option>

<option value="MFI">Money Flow Index</option>

<option value="NVI">Neg Volume Index</option>

<option value="OBV">On Balance Volume</option>

<option value="Performance">Performance</option>

<option value="PPO">% Price Oscillator</option>

<option value="PVO">% Volume Oscillator</option>

<option value="PVI">Pos Volume Index</option>

<option value="PVT">Price Volume Trend</option>

<option value="ROC">Rate of Change</option>

<option value="RSI">RSI</option>

<option value="SStoch">Slow Stochastic</option>

<option value="StochRSI">StochRSI</option>

<option value="TRIX">TRIX</option>

<option value="UO">Ultimate Oscillator</option>

<option value="Vol">Volume</option>

<option value="WilliamR">William's %R</option>

</select>

</div>

<div class="inputtitle" style="text-align:center">

<input id="Button1" name="Button1" type="submit" class="input" value="Update Chart">

</div>

</form>

</td>

<td>

<div style="font:bold 20pt arial; margin:5px 0px 0px 5px">

ChartDirector Financial Chart Demonstration

</div>

<hr style="border:solid 1px #000080" />

<br />

<img id="ChartImage" align="top" border="0">

</td>

</tr>

</table>

</body>

</html>

[JSP Version] jspdemo/financedemochart.jsp

<%@page import="ChartDirector.*, java.util.*" %>

<%!

//

// Create a finance chart based on user selections, which are encoded as query parameters. This code

// is designed to work with the financedemo HTML form.

//

// The timeStamps, volume, high, low, open and close data

private Date[] timeStamps = null;

double[] volData = null;

double[] highData = null;

double[] lowData = null;

double[] openData = null;

double[] closeData = null;

// An extra data series to compare with the close data

double[] compareData = null;

// The resolution of the data in seconds. 1 day = 86400 seconds.

int resolution = 86400;

/// <summary>

/// Get the timeStamps, highData, lowData, openData, closeData and volData.

/// </summary>

/// <param name="ticker">The ticker symbol for the data series.</param>

/// <param name="startDate">The starting date/time for the data series.</param>

/// <param name="endDate">The ending date/time for the data series.</param>

/// <param name="durationInDays">The number of trading days to get.</param>

/// <param name="extraPoints">The extra leading data points needed in order to

/// compute moving averages.</param>

/// <returns>True if successfully obtain the data, otherwise false.</returns>

protected boolean getData(String ticker, GregorianCalendar startDate, GregorianCalendar endDate,

int durationInDays, int extraPoints)

{

// This method should return false if the ticker symbol is invalid. In this sample code, as we

// are using a random number generator for the data, all ticker symbol is allowed, but we still

// assumed an empty symbol is invalid.

if ("".equals(ticker)) {

return false;

}

// In this demo, we can get 15 min, daily, weekly or monthly data depending on the time range.

resolution = 86400;

if (durationInDays <= 10) {

// 10 days or less, we assume 15 minute data points are available

resolution = 900;

// We need to adjust the startDate backwards for the extraPoints. We assume 6.5 hours

// trading time per day, and 5 trading days per week.

double dataPointsPerDay = 6.5 * 3600 / resolution;

GregorianCalendar adjustedStartDate = new GregorianCalendar(startDate.get(Calendar.YEAR),

startDate.get(Calendar.MONTH), startDate.get(Calendar.DAY_OF_MONTH));

adjustedStartDate.add(Calendar.DAY_OF_MONTH,

-(int)Math.ceil(extraPoints / dataPointsPerDay * 7 / 5) - 2);

// Get the required 15 min data

get15MinData(ticker, adjustedStartDate.getTime(), endDate.getTime());

} else if (durationInDays >= 4.5 * 360) {

// 4 years or more - use monthly data points.

resolution = 30 * 86400;

// Adjust startDate backwards to cater for extraPoints

GregorianCalendar adjustedStartDate = (GregorianCalendar)startDate.clone();

adjustedStartDate.add(Calendar.MONTH, -extraPoints);

// Get the required monthly data

getMonthlyData(ticker, adjustedStartDate.getTime(), endDate.getTime());

} else if (durationInDays >= 1.5 * 360) {

// 1 year or more - use weekly points.

resolution = 7 * 86400;

// Adjust startDate backwards to cater for extraPoints

GregorianCalendar adjustedStartDate = (GregorianCalendar)startDate.clone();

adjustedStartDate.add(Calendar.DAY_OF_MONTH, -extraPoints * 7 - 6);

// Get the required weekly data

getWeeklyData(ticker, adjustedStartDate.getTime(), endDate.getTime());

} else {

// Default - use daily points

resolution = 86400;

// Adjust startDate backwards to cater for extraPoints. We multiply the days by 7/5 as we

// assume 1 week has 5 trading days.

GregorianCalendar adjustedStartDate = new GregorianCalendar(startDate.get(Calendar.YEAR),

startDate.get(Calendar.MONTH), startDate.get(Calendar.DAY_OF_MONTH));

adjustedStartDate.add(Calendar.DAY_OF_MONTH, - (extraPoints * 7 + 4) / 5 - 2);

// Get the required daily data

getDailyData(ticker, adjustedStartDate.getTime(), endDate.getTime());

}

return true;

}

/// <summary>

/// Get 15 minutes data series for timeStamps, highData, lowData, openData, closeData

/// and volData.

/// </summary>

/// <param name="ticker">The ticker symbol for the data series.</param>

/// <param name="startDate">The starting date/time for the data series.</param>

/// <param name="endDate">The ending date/time for the data series.</param>

protected void get15MinData(String ticker, Date startDate, Date endDate)

{

//

// In this demo, we use a random number generator to generate the data. In practice, you may get

// the data from a database or by other means. If you do not have 15 minute data, you may modify

// the "drawChart" method below to not using 15 minute data.

//

generateRandomData(ticker, startDate, endDate, 900);

}

/// <summary>

/// Get daily data series for timeStamps, highData, lowData, openData, closeData

/// and volData.

/// </summary>

/// <param name="ticker">The ticker symbol for the data series.</param>

/// <param name="startDate">The starting date/time for the data series.</param>

/// <param name="endDate">The ending date/time for the data series.</param>

protected void getDailyData(String ticker, Date startDate, Date endDate)

{

//

// In this demo, we use a random number generator to generate the data. In practice, you may get

// the data from a database or by other means.

//

generateRandomData(ticker, startDate, endDate, 86400);

}

/// <summary>

/// Get weekly data series for timeStamps, highData, lowData, openData, closeData

/// and volData.

/// </summary>

/// <param name="ticker">The ticker symbol for the data series.</param>

/// <param name="startDate">The starting date/time for the data series.</param>

/// <param name="endDate">The ending date/time for the data series.</param>

protected void getWeeklyData(String ticker, Date startDate, Date endDate)

{

//

// If you do not have weekly data, you may call "getDailyData(startDate, endDate)" to get daily

// data, then call "convertDailyToWeeklyData()" to convert to weekly data.

//

generateRandomData(ticker, startDate, endDate, 86400 * 7);

}

/// <summary>

/// Get monthly data series for timeStamps, highData, lowData, openData, closeData

/// and volData.

/// </summary>

/// <param name="ticker">The ticker symbol for the data series.</param>

/// <param name="startDate">The starting date/time for the data series.</param>

/// <param name="endDate">The ending date/time for the data series.</param>

protected void getMonthlyData(String ticker, Date startDate, Date endDate)

{

//

// If you do not have weekly data, you may call "getDailyData(startDate, endDate)" to get daily

// data, then call "convertDailyToMonthlyData()" to convert to monthly data.

//

generateRandomData(ticker, startDate, endDate, 86400 * 30);

}

/// <summary>

/// A random number generator designed to generate realistic financial data.

/// </summary>

/// <param name="ticker">The ticker symbol for the data series.</param>

/// <param name="startDate">The starting date/time for the data series.</param>

/// <param name="endDate">The ending date/time for the data series.</param>

/// <param name="resolution">The period of the data series.</param>

protected void generateRandomData(String ticker, Date startDate, Date endDate, int resolution)

{

FinanceSimulator db = new FinanceSimulator(ticker, startDate, endDate, resolution);

timeStamps = db.getTimeStamps();

highData = db.getHighData();

lowData = db.getLowData();

openData = db.getOpenData();

closeData = db.getCloseData();

volData = db.getVolData();

}

/// <summary>

/// A utility to convert daily to weekly data.

/// </summary>

protected void convertDailyToWeeklyData()

{

aggregateData(new ArrayMath(timeStamps).selectStartOfWeek());

}

/// <summary>

/// A utility to convert daily to monthly data.

/// </summary>

protected void convertDailyToMonthlyData()

{

aggregateData(new ArrayMath(timeStamps).selectStartOfMonth());

}

/// <summary>

/// An internal method used to aggregate daily data.

/// </summary>

protected void aggregateData(ArrayMath aggregator)

{

timeStamps = Chart.NTime(aggregator.aggregate(Chart.CTime(timeStamps), Chart.AggregateFirst));

highData = aggregator.aggregate(highData, Chart.AggregateMax);

lowData = aggregator.aggregate(lowData, Chart.AggregateMin);

openData = aggregator.aggregate(openData, Chart.AggregateFirst);

closeData = aggregator.aggregate(closeData, Chart.AggregateLast);

volData = aggregator.aggregate(volData, Chart.AggregateSum);

}

/// <summary>

/// Create a financial chart according to user selections. The user selections are

/// encoded in the query parameters.

/// </summary>

public BaseChart drawChart(HttpServletRequest request)

{

// In this demo, we just assume we plot up to the latest time. So end date is now.

GregorianCalendar endDate = new GregorianCalendar();

// If the trading day has not yet started (before 9:30am), or if the end date is on on Sat or

// Sun, we set the end date to 4:00pm of the last trading day

while ((endDate.get(Calendar.HOUR_OF_DAY) * 60 + endDate.get(Calendar.MINUTE) <

9 * 60 + 30) || (endDate.get(Calendar.DAY_OF_WEEK) == Calendar.SUNDAY) ||

(endDate.get(Calendar.DAY_OF_WEEK) == Calendar.SATURDAY))

{

endDate.add(Calendar.DAY_OF_MONTH, -1);

endDate.set(Calendar.HOUR_OF_DAY, 16);

endDate.set(Calendar.MINUTE, 0);

endDate.set(Calendar.SECOND, 0);

}

// The duration selected by the user

int durationInDays = Integer.parseInt(request.getParameter("TimeRange"));

// Compute the start date by subtracting the duration from the end date.

GregorianCalendar startDate;

if (durationInDays >= 30) {

// More or equal to 30 days - so we use months as the unit

startDate = new GregorianCalendar(endDate.get(Calendar.YEAR),

endDate.get(Calendar.MONTH), 1);

startDate.add(Calendar.MONTH, -durationInDays / 30);

} else {

// Less than 30 days - use day as the unit. The starting point of the axis is always at the

// start of the day (9:30am). Note that we use trading days, so we skip Sat and Sun in

// counting the days.

startDate = new GregorianCalendar(endDate.get(Calendar.YEAR),

endDate.get(Calendar.MONTH), endDate.get(Calendar.DAY_OF_MONTH), 9, 30, 0);

for (int i = 1; i < durationInDays; ++i)

{

startDate.add(Calendar.DAY_OF_MONTH,

(startDate.get(Calendar.DAY_OF_WEEK) == Calendar.MONDAY) ? -3 : -1);

}

}

// The moving average periods selected by the user.

int avgPeriod1 = 0;

try { avgPeriod1 = Integer.parseInt(request.getParameter("movAvg1")); }

catch (Exception e) { avgPeriod1 = 0; }

int avgPeriod2 = 0;

try { avgPeriod2 = Integer.parseInt(request.getParameter("movAvg2")); }

catch (Exception e) { avgPeriod2 = 0; }

if (avgPeriod1 < 0) {

avgPeriod1 = 0;

} else if (avgPeriod1 > 300) {

avgPeriod1 = 300;

}

if (avgPeriod2 < 0) {

avgPeriod2 = 0;

} else if (avgPeriod2 > 300) {

avgPeriod2 = 300;

}

// We need extra leading data points in order to compute moving averages.

int extraPoints = 20;

if (avgPeriod1 > extraPoints) {

extraPoints = avgPeriod1;

}

if (avgPeriod2 > extraPoints) {

extraPoints = avgPeriod2;

}

// Get the data series to compare with, if any.

String compareKey = request.getParameter("CompareWith").trim();

compareData = null;

if (getData(compareKey, startDate, endDate, durationInDays, extraPoints)) {

compareData = closeData;

}

// The data series we want to get.

String tickerKey = request.getParameter("TickerSymbol").trim();

if (!getData(tickerKey, startDate, endDate, durationInDays, extraPoints)) {

return errMsg("Please enter a valid ticker symbol");

}

// We now confirm the actual number of extra points (data points that are before the start date)

// as inferred using actual data from the database.

extraPoints = timeStamps.length;

Date cutOff = startDate.getTime();

for (int i = 0; i < timeStamps.length; ++i)

{

if (!timeStamps[i].before(cutOff))

{

extraPoints = i;

break;

}

}

// Check if there is any valid data

if (extraPoints >= timeStamps.length) {

// No data - just display the no data message.

return errMsg("No data available for the specified time period");

}

// In some finance chart presentation style, even if the data for the latest day is not fully

// available, the axis for the entire day will still be drawn, where no data will appear near

// the end of the axis.

if (resolution < 86400) {

// Add extra points to the axis until it reaches the end of the day. The end of day is

// assumed to be 16:00 (it depends on the stock exchange).

GregorianCalendar lastTime = new GregorianCalendar();

lastTime.setTime(timeStamps[timeStamps.length - 1]);

int extraTrailingPoints = (int)((16 * 3600 - lastTime.get(Calendar.HOUR_OF_DAY) * 3600

- lastTime.get(Calendar.MINUTE) * 60 - lastTime.get(Calendar.SECOND)) / resolution);

if (extraTrailingPoints > 0)

{

Date[] extendedTimeStamps = new Date[timeStamps.length + extraTrailingPoints];

System.arraycopy(timeStamps, 0, extendedTimeStamps, 0, timeStamps.length);

for (int i = 0; i < extraTrailingPoints; ++i)

{

lastTime.add(Calendar.SECOND, resolution);

extendedTimeStamps[i + timeStamps.length] = (Date)lastTime.getTime().clone();

}

timeStamps = extendedTimeStamps;

}

}

//

// At this stage, all data are available. We can draw the chart as according to user input.

//

//

// Determine the chart size. In this demo, user can select 4 different chart sizes. Default is

// the large chart size.

//

int width = 780;

int mainHeight = 255;

int indicatorHeight = 80;

String size = request.getParameter("ChartSize");

if ("S".equals(size)) {

// Small chart size

width = 450;

mainHeight = 160;

indicatorHeight = 60;

} else if ("M".equals(size)) {

// Medium chart size

width = 620;

mainHeight = 215;

indicatorHeight = 70;

} else if ("H".equals(size)) {

// Huge chart size

width = 1000;

mainHeight = 320;

indicatorHeight = 90;

}

// Create the chart object using the selected size

FinanceChart m = new FinanceChart(width);

// Set the data into the chart object

m.setData(timeStamps, highData, lowData, openData, closeData, volData, extraPoints);

//

// We configure the title of the chart. In this demo chart design, we put the company name as

// the top line of the title with left alignment.

//

m.addPlotAreaTitle(Chart.TopLeft, tickerKey);

// We displays the current date as well as the data resolution on the next line.

String resolutionText = "";

if (resolution == 30 * 86400) {

resolutionText = "Monthly";

} else if (resolution == 7 * 86400) {

resolutionText = "Weekly";

} else if (resolution == 86400) {

resolutionText = "Daily";

} else if (resolution == 900) {

resolutionText = "15-min";

}

m.addPlotAreaTitle(Chart.BottomLeft, "<*font=Arial,size=8*>" + m.formatValue(new Date(),

"mmm dd, yyyy") + " - " + resolutionText + " chart");

// A copyright message at the bottom left corner the title area

m.addPlotAreaTitle(Chart.BottomRight, "<*font=Arial,size=8*>(c) Advanced Software Engineering");

//

// Add the first techical indicator according. In this demo, we draw the first indicator on top

// of the main chart.

//

addIndicator(m, request.getParameter("Indicator1"), indicatorHeight);

//

// Add the main chart

//

m.addMainChart(mainHeight);

//

// Set log or linear scale according to user preference

//

if ("1".equals(request.getParameter("LogScale"))) {

m.setLogScale(true);

}

//

// Set axis labels to show data values or percentage change to user preference

//

if ("1".equals(request.getParameter("PercentageScale"))) {

m.setPercentageAxis();

}

//

// Draw any price line the user has selected

//

String mainType = request.getParameter("ChartType");

if ("Close".equals(mainType)) {

m.addCloseLine(0x000040);

} else if ("TP".equals(mainType)) {

m.addTypicalPrice(0x000040);

} else if ("WC".equals(mainType)) {

m.addWeightedClose(0x000040);

} else if ("Median".equals(mainType)) {

m.addMedianPrice(0x000040);

}

//

// Add comparison line if there is data for comparison

//

if (compareData != null) {

if (compareData.length > extraPoints) {

m.addComparison(compareData, 0x0000ff, compareKey);

}

}

//

// Add moving average lines.

//

addMovingAvg(m, request.getParameter("avgType1"), avgPeriod1, 0x663300);

addMovingAvg(m, request.getParameter("avgType2"), avgPeriod2, 0x9900ff);

//

// Draw candlesticks or OHLC symbols if the user has selected them.

//

if ("CandleStick".equals(mainType)) {

m.addCandleStick(0x33ff33, 0xff3333);

} else if ("OHLC".equals(mainType)) {

m.addHLOC(0x008800, 0xcc0000);

}

//

// Add parabolic SAR if necessary

//

if ("1".equals(request.getParameter("ParabolicSAR"))) {

m.addParabolicSAR(0.02, 0.02, 0.2, Chart.DiamondShape, 5, 0x008800, 0x000000);

}

//

// Add price band/channel/envelop to the chart according to user selection

//

String bandType = request.getParameter("Band");

if ("BB".equals(bandType)) {

m.addBollingerBand(20, 2, 0x9999ff, 0xc06666ff);

} else if ("DC".equals(bandType)) {

m.addDonchianChannel(20, 0x9999ff, 0xc06666ff);

} else if ("Envelop".equals(bandType)) {

m.addEnvelop(20, 0.1, 0x9999ff, 0xc06666ff);

}

//

// Add volume bars to the main chart if necessary

//

if ("1".equals(request.getParameter("Volume"))) {

m.addVolBars(indicatorHeight, 0x99ff99, 0xff9999, 0xc0c0c0);

}

//

// Add additional indicators as according to user selection.

//

addIndicator(m, request.getParameter("Indicator2"), indicatorHeight);

addIndicator(m, request.getParameter("Indicator3"), indicatorHeight);

addIndicator(m, request.getParameter("Indicator4"), indicatorHeight);

return m;

}

/// <summary>

/// Add a moving average line to the FinanceChart object.

/// </summary>

/// <param name="m">The FinanceChart object to add the line to.</param>

/// <param name="avgType">The moving average type (SMA/EMA/TMA/WMA).</param>

/// <param name="avgPeriod">The moving average period.</param>

/// <param name="color">The color of the line.</param>

/// <returns>The LineLayer object representing line layer created.</returns>

protected LineLayer addMovingAvg(FinanceChart m, String avgType, int avgPeriod, int color)

{

if (avgPeriod > 1) {

if ("SMA".equals(avgType)) {

return m.addSimpleMovingAvg(avgPeriod, color);

} else if ("EMA".equals(avgType)) {

return m.addExpMovingAvg(avgPeriod, color);

} else if ("TMA".equals(avgType)) {

return m.addTriMovingAvg(avgPeriod, color);

} else if ("WMA".equals(avgType)) {

return m.addWeightedMovingAvg(avgPeriod, color);

}

}

return null;

}

/// <summary>

/// Add an indicator chart to the FinanceChart object. In this demo example, the

/// indicator parameters (such as the period used to compute RSI, colors of the lines,

/// etc.) are hard coded to commonly used values. You are welcome to design a more

/// complex user interface to allow users to set the parameters.

/// </summary>

/// <param name="m">The FinanceChart object to add the line to.</param>

/// <param name="indicator">The selected indicator.</param>

/// <param name="height">Height of the chart in pixels</param>

/// <returns>The XYChart object representing indicator chart.</returns>

protected XYChart addIndicator(FinanceChart m, String indicator, int height)

{

if ("RSI".equals(indicator)) {

return m.addRSI(height, 14, 0x800080, 20, 0xff6666, 0x6666ff);

} else if ("StochRSI".equals(indicator)) {

return m.addStochRSI(height, 14, 0x800080, 30, 0xff6666, 0x6666ff);

} else if ("MACD".equals(indicator)) {

return m.addMACD(height, 26, 12, 9, 0x0000ff, 0xff00ff, 0x008000);

} else if ("FStoch".equals(indicator)) {

return m.addFastStochastic(height, 14, 3, 0x006060, 0x606000);

} else if ("SStoch".equals(indicator)) {

return m.addSlowStochastic(height, 14, 3, 0x006060, 0x606000);

} else if ("ATR".equals(indicator)) {

return m.addATR(height, 14, 0x808080, 0x0000ff);

} else if ("ADX".equals(indicator)) {

return m.addADX(height, 14, 0x008000, 0x800000, 0x000080);

} else if ("DCW".equals(indicator)) {

return m.addDonchianWidth(height, 20, 0x0000ff);

} else if ("BBW".equals(indicator)) {

return m.addBollingerWidth(height, 20, 2, 0x0000ff);

} else if ("DPO".equals(indicator)) {

return m.addDPO(height, 20, 0x0000ff);

} else if ("PVT".equals(indicator)) {

return m.addPVT(height, 0x0000ff);

} else if ("Momentum".equals(indicator)) {

return m.addMomentum(height, 12, 0x0000ff);

} else if ("Performance".equals(indicator)) {

return m.addPerformance(height, 0x0000ff);

} else if ("ROC".equals(indicator)) {

return m.addROC(height, 12, 0x0000ff);

} else if ("OBV".equals(indicator)) {

return m.addOBV(height, 0x0000ff);

} else if ("AccDist".equals(indicator)) {

return m.addAccDist(height, 0x0000ff);

} else if ("CLV".equals(indicator)) {

return m.addCLV(height, 0x0000ff);

} else if ("WilliamR".equals(indicator)) {

return m.addWilliamR(height, 14, 0x800080, 30, 0xff6666, 0x6666ff);

} else if ("Aroon".equals(indicator)) {

return m.addAroon(height, 14, 0x339933, 0x333399);

} else if ("AroonOsc".equals(indicator)) {

return m.addAroonOsc(height, 14, 0x0000ff);

} else if ("CCI".equals(indicator)) {

return m.addCCI(height, 20, 0x800080, 100, 0xff6666, 0x6666ff);

} else if ("EMV".equals(indicator)) {

return m.addEaseOfMovement(height, 9, 0x006060, 0x606000);

} else if ("MDX".equals(indicator)) {

return m.addMassIndex(height, 0x800080, 0xff6666, 0x6666ff);

} else if ("CVolatility".equals(indicator)) {

return m.addChaikinVolatility(height, 10, 10, 0x0000ff);

} else if ("COscillator".equals(indicator)) {

return m.addChaikinOscillator(height, 0x0000ff);

} else if ("CMF".equals(indicator)) {

return m.addChaikinMoneyFlow(height, 21, 0x008000);

} else if ("NVI".equals(indicator)) {

return m.addNVI(height, 255, 0x0000ff, 0x883333);

} else if ("PVI".equals(indicator)) {

return m.addPVI(height, 255, 0x0000ff, 0x883333);

} else if ("MFI".equals(indicator)) {

return m.addMFI(height, 14, 0x800080, 30, 0xff6666, 0x6666ff);

} else if ("PVO".equals(indicator)) {

return m.addPVO(height, 26, 12, 9, 0x0000ff, 0xff00ff, 0x008000);

} else if ("PPO".equals(indicator)) {

return m.addPPO(height, 26, 12, 9, 0x0000ff, 0xff00ff, 0x008000);

} else if ("UO".equals(indicator)) {

return m.addUltimateOscillator(height, 7, 14, 28, 0x800080, 20, 0xff6666, 0x6666ff);

} else if ("Vol".equals(indicator)) {

return m.addVolIndicator(height, 0x99ff99, 0xff9999, 0xc0c0c0);

} else if ("TRIX".equals(indicator)) {

return m.addTRIX(height, 12, 0x0000ff);

}

return null;

}

/// <summary>

/// Creates a dummy chart to show an error message.

/// </summary>

/// <param name="msg">The error message.

/// <returns>The BaseChart object containing the error message.</returns>

protected BaseChart errMsg(String msg)

{

MultiChart m = new MultiChart(400, 200);

m.addTitle2(Chart.Center, msg, "Arial", 10).setMaxWidth(m.getWidth());

return m;

}

%>

<%

// Create the finance chart

BaseChart c = drawChart(request);

// Stream chart to the browser

WebChartViewer viewer = new WebChartViewer(request, "chart1");

viewer.setChart(c, Chart.SVG);

if (viewer.streamChart(response))

return;

%>

© 2021 Advanced Software Engineering Limited. All rights reserved.